The race to launch the first spot Solana ETF in the United States is intensifying as multiple major asset managers have submitted applications to the Securities and Exchange Commission, setting the stage for a potential breakthrough in altcoin investment products. The filings represent a significant test of the SEC’s evolving stance on cryptocurrency ETFs beyond Bitcoin and Ethereum.

Leading the charge are industry heavyweights Franklin Templeton, Grayscale, VanEck, 21Shares, Bitwise, and Canary Capital, all seeking regulatory approval to offer investors exposure to SOL, Solana’s native cryptocurrency. The growing list of applicants signals strong institutional confidence in Solana’s long-term prospects and the broader maturation of the cryptocurrency market.

The Regulatory Challenge

Despite the enthusiasm from asset managers, Solana ETF applications face significant regulatory hurdles. The SEC has historically classified Solana as a potential security, creating complications for ETF approval. Unlike Bitcoin and Ethereum, which have achieved broader regulatory acceptance as commodities, Solana’s security status remains a contentious issue.

The SEC typically requires established futures markets for cryptocurrencies before approving spot ETFs, a benchmark Solana has yet to meet. However, the recent introduction of Solana futures contracts on the Chicago Mercantile Exchange (CME) could help address this concern, though these products are still relatively new and lack the track record of Bitcoin and Ethereum futures.

Security classification concerns are compounded by other challenges:

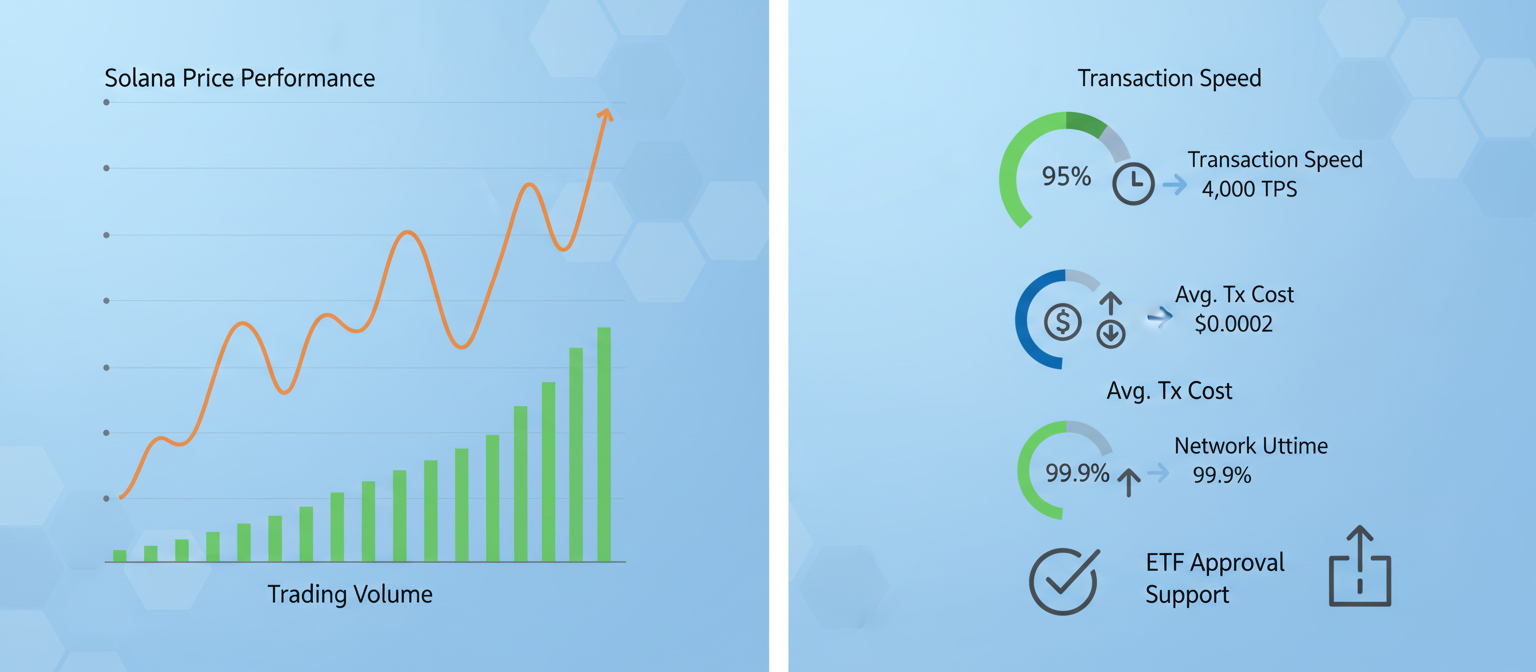

Network Reliability: Solana’s history of network outages and performance issues has raised questions about its readiness for institutional-grade investment products. Critics point to several high-profile downtime incidents as evidence of insufficient network maturity.

Centralization Concerns: With approximately 2,000 active validators, Solana’s decentralization has been questioned compared to Ethereum’s more distributed validator network. This relatively low validator count could influence the SEC’s assessment of the network’s resilience and governance structure.

Market Maturity: Solana, while having achieved significant market adoption, is still considered a newer project compared to Bitcoin and Ethereum, potentially affecting regulatory comfort levels.

Market Context and Timing

The timing of these Solana ETF applications is particularly significant, coming as the cryptocurrency market continues to evolve following the successful launches of Bitcoin and Ethereum ETFs. The market has seen substantial institutional inflows into existing crypto ETFs, with Bitcoin spot ETFs attracting over $36 billion in net inflows since their January 2024 launch.

However, Ethereum ETFs have seen more modest success, generating approximately $2.4 billion in net inflows since their July 2024 debut. This performance disparity suggests that institutional investors may be more cautious about altcoin exposure, which could impact the reception of Solana ETFs.

The Solana ETF applications also follow recent SEC approval of Bitcoin-Ethereum combination ETFs from Hashdex and Franklin Templeton, indicating a potential warming of regulatory attitudes toward more sophisticated crypto investment products.

Asset Manager Strategies

Each of the applying asset managers brings unique strengths and strategies to their Solana ETF proposals:

Franklin Templeton: Leveraging its recent success with the Bitcoin-Ethereum combo ETF (EZPZ), Franklin Templeton brings established distribution channels and institutional credibility to the Solana ETF race.

Grayscale: Already managing the Grayscale Solana Trust (GSOL), the company has existing infrastructure and investor relationships that could facilitate a smooth transition to an ETF structure if approved.

VanEck: With extensive experience in launching ETFs across various asset classes, VanEck brings sophisticated product development capabilities and regulatory expertise.

21Shares: As a specialist in cryptocurrency ETPs, 21Shares offers focused expertise in digital asset products and established relationships with crypto-native investors.

Bitwise: Known for its research-driven approach and crypto-focused investment strategies, Bitwise could appeal to sophisticated investors seeking dedicated crypto exposure.

International Precedent

The Solana ETF race isn’t limited to the United States. Canada has already launched the first spot Solana ETF (SOLL) on the Toronto Stock Exchange as of April 2025, providing an important international precedent. The success or challenges of the Canadian product could influence SEC decision-making and demonstrate investor appetite for Solana exposure.

European markets have also seen growing interest in Solana-based investment products, with several ETP providers offering exposure to SOL through various fund structures. This international experience could help address regulatory concerns about market demand and product viability.

Potential Market Impact

If approved, Solana ETFs could have significant implications for both the cryptocurrency market and traditional finance:

Price Impact: ETF approval could trigger substantial buying pressure on SOL, potentially driving significant price appreciation similar to patterns observed following Bitcoin ETF approvals.

Market Validation: SEC approval would represent strong validation of Solana’s technological and governance maturity, potentially accelerating institutional adoption.

Liquidity Enhancement: ETF products would provide new sources of liquidity for SOL markets, potentially reducing volatility and improving market efficiency.

Mainstream Access: Traditional investors would gain regulated, convenient access to Solana exposure, potentially broadening the investor base significantly.

Timeline and Expectations

The SEC has pushed decision deadlines on Solana ETF applications to various dates in 2025, with some applications facing final decisions as late as October 2025. This extended timeline reflects the complexity and novelty of the applications, as well as the SEC’s cautious approach to altcoin investment products.

Industry observers expect the SEC to take a methodical approach, potentially using the Solana ETF applications to establish clearer regulatory frameworks for altcoin investment products more broadly. The outcome could set important precedents for other cryptocurrencies seeking ETF approval.

Risk Factors and Considerations

Investors and industry participants should consider several risk factors related to potential Solana ETFs:

Regulatory Uncertainty: The security classification issue remains unresolved, and adverse regulatory decisions could impact both ETF approval and SOL’s market status.

Technical Risks: Network performance issues or security vulnerabilities could undermine confidence in Solana-based investment products.

Market Volatility: SOL has demonstrated high volatility, which could be exacerbated by ETF-related trading dynamics.

Competition: The cryptocurrency ETF space is becoming increasingly crowded, with new products potentially competing for the same investor capital.

Conclusion

The wave of Solana ETF applications represents a crucial moment for the cryptocurrency industry, testing regulatory openness to altcoin investment products and potentially opening new pathways for institutional crypto adoption. While significant challenges remain, the growing interest from major asset managers demonstrates increasing confidence in both Solana’s technological foundation and the broader maturation of the crypto market.

The SEC’s decisions on these applications will be closely watched as indicators of the regulatory landscape for cryptocurrency investment products beyond Bitcoin and Ethereum. Whether approved or denied, the outcome will provide important guidance for the future development of the cryptocurrency ETF market.

This analysis reflects the Solana ETF application landscape as of October 10, 2024. Regulatory decisions and market conditions may have evolved since this publication.