In a landmark vote that marks cryptocurrency’s biggest legislative victory to date, the U.S. Senate today passed the GENIUS Act by a decisive 68-30 margin, establishing the first comprehensive federal regulatory framework for stablecoins and potentially clearing the path for the $251 billion digital dollar market to operate with regulatory certainty.

The bipartisan passage of the Guiding and Establishing National Innovation for U.S. Stablecoins Act represents a watershed moment for the crypto industry, which has long sought clear rules from Congress rather than enforcement-driven regulation from agencies.

What the GENIUS Act Does

The legislation creates a dual regulatory framework that allows both federally-licensed and state-chartered issuers to operate stablecoins, while establishing strict requirements designed to protect consumers and maintain financial stability.

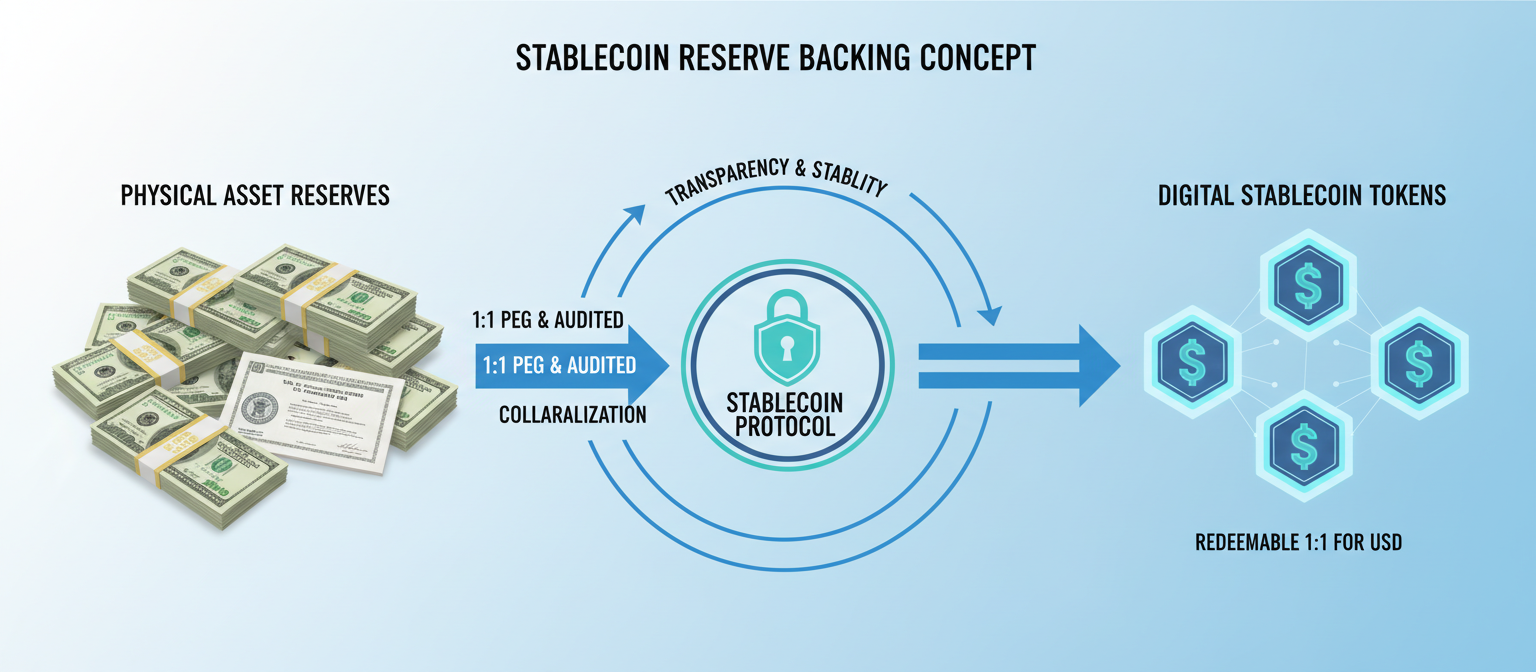

Reserve Requirements: The cornerstone of the GENIUS Act mandates that all payment stablecoins maintain 1:1 reserve backing in high-quality liquid assets. This means every dollar-denominated stablecoin in circulation must be backed by an actual dollar or equivalent safe asset, ensuring that holders can redeem their tokens at face value.

Issuers must provide monthly public disclosures of their reserve compositions, bringing unprecedented transparency to an industry that has faced scrutiny over reserve adequacy. Companies with over $50 billion in outstanding stablecoins face even stricter oversight, requiring annual audited financial statements.

Dual Licensing Regime: The act establishes two pathways for stablecoin issuers:

- Federal licensing for nonbank issuers with over $10 billion in stablecoins, overseen by the Office of the Comptroller of the Currency

- State-chartered issuers can continue operating under state oversight, provided their state frameworks are “substantially similar” to federal standards

This dual approach balances the need for uniform consumer protection with traditional state-level banking regulation, a compromise that helped secure bipartisan support.

Compliance Requirements: All issuers must comply with Bank Secrecy Act provisions and anti-money laundering regulations, addressing longstanding concerns about stablecoins potentially facilitating illicit finance. The framework brings stablecoin issuers into the same compliance regime that governs traditional money transmitters.

Restrictions on Non-Financial Entities: The legislation includes provisions limiting the ability of large non-financial public companies to issue stablecoins, addressing concerns about tech giants potentially dominating the digital payments landscape and creating systemic risks.

The Path to Passage

The GENIUS Act’s journey to today’s vote reflects months of negotiation and compromise between crypto advocates and skeptics, Democrats and Republicans, and competing visions of how to regulate digital assets.

The Senate Banking Committee advanced the bill in April following extensive hearings on stablecoin risks and benefits. Key negotiations centered on the balance between federal and state oversight, with some senators pushing for exclusive federal jurisdiction while others defended state regulators’ roles.

The final 68-30 vote demonstrated remarkable bipartisan support in a polarized political environment. Approximately half of Senate Democrats joined the Republican majority in backing the legislation, viewing stablecoins as both an innovation opportunity and a means of reinforcing dollar dominance in digital payments.

Sen. Cynthia Lummis, a leading crypto advocate, has emphasized the urgency of passing comprehensive crypto legislation, stating that Congress must deliver both stablecoin regulation and broader market structure rules by year’s end. The GENIUS Act represents the first major piece of that agenda to cross the finish line.

Industry Impact and Market Size

The GENIUS Act will govern a stablecoin market that has grown explosively to reach $251 billion in total capitalization as of June 2025, marking the twenty-first consecutive month of growth.

The legislation covers over 90% of existing fiat-backed stablecoins, with the two dominant players standing to be most immediately affected:

Tether (USDT): With $156 billion in circulation as of June 2025, Tether commands 62.1% of the stablecoin market. The company will need to demonstrate full compliance with the act’s reserve and transparency requirements, potentially requiring significant operational changes. Tether has historically faced questions about its reserve composition and audit practices.

USD Coin (USDC): Circle’s USDC, with approximately $58-60 billion in circulation, is already positioned relatively well for compliance given its existing reserve attestations and regulatory engagement. Circle’s recent public market debut on June 4, which saw its stock rally dramatically to value the company at $58.6 billion, reflects investor confidence in the stablecoin market’s regulatory trajectory.

Smaller stablecoin issuers will face decisions about whether to seek federal licenses, operate under state charters, or exit the market if compliance costs prove prohibitive.

The framework also opens the door for new entrants, potentially including banks, fintechs, and major retailers looking to launch their own stablecoins or integrate them into existing payment systems. With clear rules now established, institutions that previously remained on the sidelines may enter the market.

What Happens Next

Despite today’s Senate victory, the GENIUS Act still faces hurdles before becoming law. The House of Representatives has advanced its own stablecoin legislation, the STABLE Act (Stablecoin Transparency and Accountability for a Better Ledger Economy Act), which shares many provisions with the Senate bill but includes notable differences.

The two chambers will need to reconcile their approaches, likely through a conference committee that will negotiate a unified version acceptable to both House and Senate majorities. Areas of potential disagreement include:

- The precise threshold for mandatory federal licensing versus state oversight

- Specific reserve composition requirements and acceptable liquid assets

- Timeline for implementation and compliance

- Enforcement mechanisms and penalties for violations

Industry observers expect the reconciliation process to move relatively quickly given the broad bipartisan consensus on the need for stablecoin regulation. President Trump has indicated support for crypto-friendly legislation, including the GENIUS Act as passed by the Senate, improving the likelihood of eventual enactment.

Once a final bill reaches the president’s desk and is signed into law, regulatory agencies will need to develop implementing regulations, guidance, and examination procedures. This rulemaking process could take several months, meaning full compliance may not be required until 2026.

Broader Implications for Crypto Regulation

The GENIUS Act’s passage carries significance beyond stablecoins themselves. It represents Congress’s first major cryptocurrency legislation, potentially serving as a template for addressing other digital asset categories.

Regulatory Certainty: For years, the crypto industry has operated in a regulatory gray zone, with agencies like the SEC and CFTC asserting overlapping jurisdiction and often taking enforcement actions rather than establishing clear prospective rules. Congressional legislation provides the certainty that industry participants have long sought, potentially encouraging additional investment and innovation.

Dollar Dominance: By creating a clear framework for dollar-backed stablecoins, Congress aims to ensure U.S. stablecoins remain the global standard for digital payments. Currently, USDT and USDC dominate international crypto trading and cross-border payments. The legislation helps cement this position against potential competition from foreign stablecoins or central bank digital currencies.

State vs. Federal Balance: The dual licensing approach reflects ongoing debates about financial regulation’s proper level of government. By preserving state regulators’ roles while establishing federal standards, the act may influence how Congress approaches other fintech innovations.

Template for Future Legislation: Sen. Lummis and other crypto advocates have emphasized that stablecoins are just the first step, with broader market structure legislation needed to address the regulatory status of other digital assets, exchange oversight, and DeFi protocols. The GENIUS Act’s bipartisan success may provide momentum for these additional efforts.

Looking Ahead

Today’s vote marks a pivotal moment in cryptocurrency’s evolution from a fringe technology to a regulated component of the mainstream financial system. After years of calling for Congressional action, the crypto industry now faces the reality of federal oversight with all its compliance costs and operational requirements.

For consumers and businesses using stablecoins, the legislation promises greater protection and confidence that their digital dollars are actually backed by real reserves. For the broader financial system, it brings a $251 billion and rapidly growing market under regulatory supervision, reducing systemic risks.

The coming months will reveal how quickly the House and Senate can reconcile their bills and how effectively regulatory agencies can implement the new framework. But regardless of those details, June 17, 2025 will be remembered as the day cryptocurrency regulation in the United States fundamentally changed—and the stablecoin industry began operating under clear rules of the road.

This article reflects information available as of June 17, 2025.