In a stunning display of regulatory whiplash, the Securities and Exchange Commission approved Grayscale’s groundbreaking multi-asset cryptocurrency ETF on July 1, only to suspend the approval less than 24 hours later on July 2, throwing the industry’s first diversified crypto fund into regulatory limbo and raising fresh questions about the SEC’s approach to digital asset products.

The rapid reversal of the $755 million Grayscale Digital Large Cap Fund (GDLC) approval marks an unprecedented moment in crypto ETF history and underscores the continued uncertainty facing cryptocurrency investment products despite growing institutional demand.

The Groundbreaking Approval

On July 1, 2025, the SEC approved a rule change allowing the Grayscale Digital Large Cap Fund to convert from a trust structure to a spot exchange-traded fund and list on NYSE Arca. The approval represented a watershed moment for the cryptocurrency industry—marking the first time the SEC greenlit a multi-asset crypto ETF in the United States.

Unlike the Bitcoin and Ethereum single-asset ETFs that have already received approval, GDLC bundles exposure to five major cryptocurrencies: Bitcoin, Ethereum, XRP, Solana, and Cardano. This diversified approach mirrors traditional market-cap weighted index funds that have become staples of equity investing, but applied to the digital asset space.

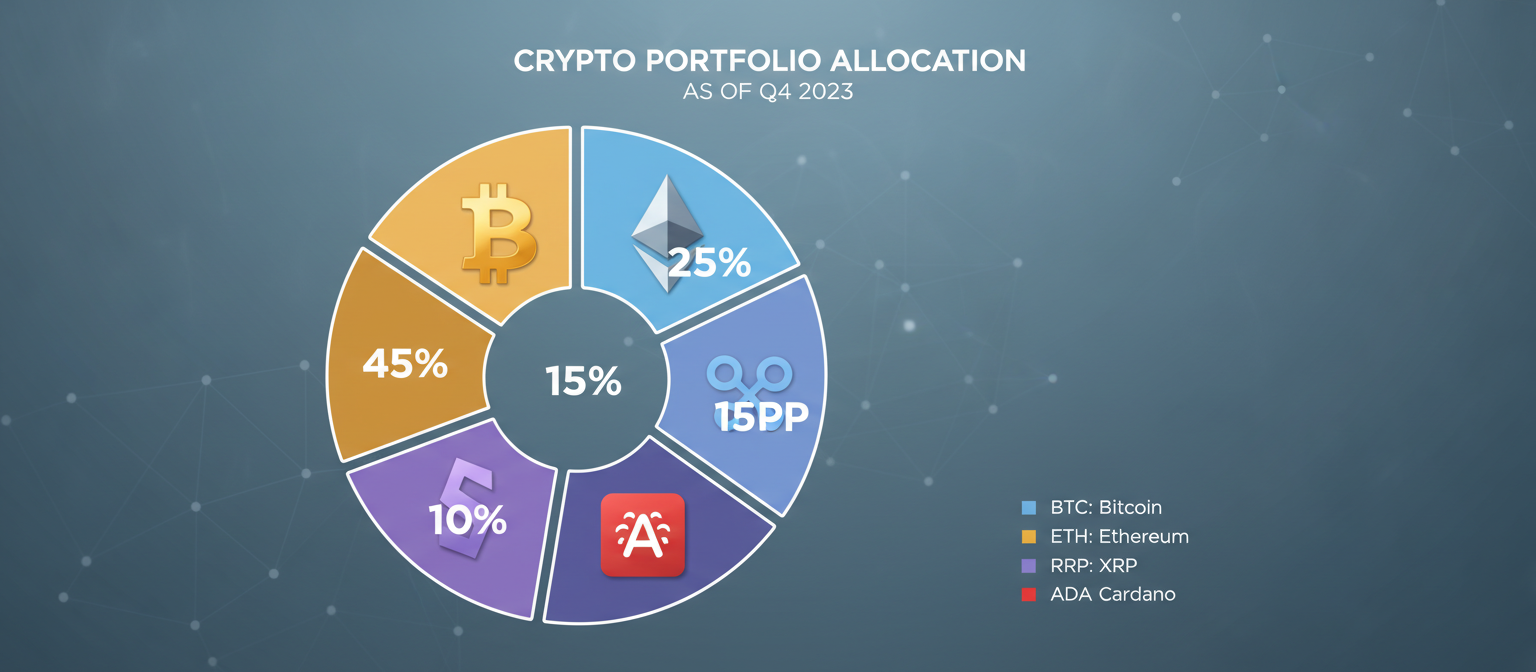

The fund tracks the CoinDesk 5 Index (CD5), which measures the performance of the five largest and most liquid digital assets by market capitalization. At the time of approval, the fund’s allocation stood at approximately:

- Bitcoin: ~80% (the dominant position reflecting BTC’s market cap leadership)

- Ethereum: ~11% (the second-largest cryptocurrency)

- XRP: ~4.8% (Ripple’s native token)

- Solana: ~2.8% (high-performance blockchain platform)

- Cardano: ~0.8% (proof-of-stake blockchain)

The approval seemed to signal a new era of SEC openness to diversified cryptocurrency products, particularly notable for the inclusion of XRP, Solana, and Cardano—assets that have faced varying degrees of regulatory scrutiny.

The Swift Reversal

The celebration proved short-lived. Just hours after the July 1 approval, the SEC issued a letter stating it would “review the delegated action” and placing an immediate stay on the approval order “until the Commission orders otherwise.”

The initial approval had been granted through what’s known as “delegated authority”—a process where SEC staff can approve routine filings without requiring a full vote by the five-member commission. However, any commissioner can request a review of delegated actions, effectively pausing implementation while the full commission examines the decision.

The SEC’s terse notification letter provided no specific rationale for the review, stating only: “This letter is to notify you that… the Commission will review the delegated action.”

This procedural move immediately halted Grayscale’s plans to begin trading the ETF shares and left the fund in an uncertain status. While the fund continues to exist as a private trust holding $755 million in digital assets, its transformation into a publicly traded ETF remains on hold pending the commission’s review.

What’s in the Fund?

The Grayscale Digital Large Cap Fund has operated as a private trust since its inception, allowing accredited investors to gain diversified cryptocurrency exposure through a single investment vehicle. The fund currently holds approximately $755 million in digital assets, making it one of the largest multi-asset cryptocurrency funds globally.

The fund’s portfolio automatically rebalances quarterly to maintain alignment with the CoinDesk 5 Index, which weights constituents by market capitalization. This means the allocations shift over time as the relative market caps of the included cryptocurrencies change—a dynamic that has particularly benefited Ethereum and Solana during periods of strong performance.

For investors, the multi-asset structure offers several potential advantages over single-asset crypto ETFs:

Diversification: Rather than betting on a single cryptocurrency, investors gain exposure to the five largest digital assets, potentially reducing volatility compared to holding any single token.

Simplified Access: One ticker provides instant exposure to multiple cryptocurrencies, eliminating the need to research, purchase, and manage several different assets.

Automatic Rebalancing: The quarterly rebalancing maintains target allocations without requiring investor action, similar to traditional index funds.

Institutional Infrastructure: Trading through traditional brokerage accounts rather than cryptocurrency exchanges, with familiar regulatory oversight and investor protections.

The inclusion of XRP, Solana, and Cardano alongside Bitcoin and Ethereum is particularly significant. These assets have historically faced more regulatory uncertainty than BTC and ETH, making their appearance in an SEC-reviewed fund potentially precedent-setting—assuming the approval ultimately moves forward.

Regulatory Uncertainty and What’s Next

Grayscale’s response to the suspension reflected both disappointment and determination. A company spokesperson called the development “unexpected” but noted that it reflects the “dynamic and evolving” regulatory landscape for digital assets. The firm stated it remains “committed to pursuing the listing of GDLC as an ETP.”

The suspension raises several important questions about the SEC’s decision-making process:

Why the reversal? The SEC has not disclosed which commissioner(s) requested the review or what specific concerns prompted the stay. Possibilities include questions about the surveillance-sharing arrangements for the included assets, concerns about market manipulation potential for the smaller-cap tokens, or broader policy disagreements about multi-asset crypto products.

How long will the review take? The SEC provided no timeline for completing its review. Similar reviews in the past have taken weeks to months, leaving Grayscale and potential investors in an extended period of uncertainty.

What does this mean for other crypto ETF applications? Numerous issuers have filed applications for single-asset and multi-asset crypto ETFs covering various digital assets. The GDLC suspension could signal increased scrutiny for all pending applications, or it could prove to be a unique case related to the specific composition of the fund.

Precedent for future products: If the SEC ultimately approves GDLC after its review, it could open the floodgates for other diversified crypto products. Conversely, a final rejection would likely chill the market for multi-asset crypto ETFs and reinforce the preference for single-asset Bitcoin and Ethereum products.

Industry observers note that the approval-then-suspension sequence is highly unusual. Typically, the SEC either approves, rejects, or requests additional information before making a decision. The reversal of a delegated approval suggests either a procedural irregularity in the initial review or significant disagreement among commissioners about the appropriate path forward.

Implications for the Crypto ETF Landscape

The GDLC saga arrives at a critical juncture for cryptocurrency investment products. Following the successful launches of spot Bitcoin and Ethereum ETFs earlier this year, the industry had anticipated a gradual expansion to include other digital assets and diversified products.

The July 1 approval briefly seemed to confirm that trajectory, potentially validating regulatory frameworks for XRP, Solana, and Cardano by extension. The subsequent suspension, however, demonstrates that the path to broader crypto ETF offerings remains fraught with regulatory challenges.

For investors waiting for simplified access to diversified cryptocurrency portfolios through traditional brokerage accounts, the GDLC suspension extends the timeline for such products. Currently, investors seeking multi-asset crypto exposure must either:

- Purchase multiple single-asset ETFs separately

- Use cryptocurrency exchanges to build portfolios directly

- Invest in crypto-focused venture funds or trusts with limited liquidity

- Wait for regulatory clarity on multi-asset products

The situation also highlights the continued tension between crypto industry innovation and regulatory caution. While industry participants push for product variety and expanded access, regulators appear to be taking a measured approach—approving thoroughly vetted products while maintaining strict oversight of novel structures.

Looking ahead, the crypto ETF market will be watching closely for the SEC’s final decision on GDLC. That ruling could either accelerate the diversification of crypto investment products or reinforce a more conservative approach focused primarily on Bitcoin and Ethereum.

This article reflects information available as of July 3, 2025.