In a landmark decision that could reshape the cryptocurrency investment landscape, the U.S. Securities and Exchange Commission voted on September 17, 2025, to approve generic listing standards for exchange-traded products holding spot commodities, including digital assets.

This regulatory breakthrough eliminates the lengthy case-by-case approval process that has historically delayed crypto ETF launches, potentially opening the floodgates for a new wave of digital asset investment products in the coming months.

What Are Generic Listing Standards?

Generic listing standards represent a fundamental shift in how crypto ETFs can be brought to market. Under the newly approved framework, national securities exchanges can now list and trade qualifying exchange-traded products without first submitting individual proposed rule changes to the SEC under Section 19(b) of the Securities Exchange Act of 1934.

The SEC approved rule changes from three major exchanges—Nasdaq, NYSE Arca, and Cboe BZX—enabling them to list and trade commodity-based trust shares, including those holding spot digital assets, through a standardized framework rather than product-by-product reviews.

This brings crypto ETFs in line with traditional commodity-based funds under Rule 6c-11, eliminating a process that could previously take up to 240 days for each individual product.

The Eligibility Criteria

To qualify for listing under the new generic standards, a commodity must meet specific criteria designed to ensure market integrity and investor protection:

-

Trade on ISG member market: The commodity may trade on a market that is an Intermarket Surveillance Group (ISG) member, ensuring robust surveillance-sharing agreements are in place

-

Active futures contracts: The commodity must underlie a futures contract that has traded for at least six months on a CFTC-regulated designated contract market, demonstrating established price discovery mechanisms

-

Existing ETF exposure: If an exchange-traded fund providing economic exposure of at least 40% of its net asset value to a specific commodity already lists and trades on a national securities exchange, ETPs providing exposure to the same commodity can also qualify

These requirements are designed to ensure that only digital assets with sufficient liquidity, established trading infrastructure, and regulatory oversight can be included in ETFs listed under the generic framework.

Grayscale’s Multi-Asset Fund: First Through the Gate

In conjunction with approving the generic listing standards, the SEC simultaneously approved the listing and trading of the Grayscale Digital Large Cap Fund, which holds spot digital assets based on the CoinDesk 5 Index.

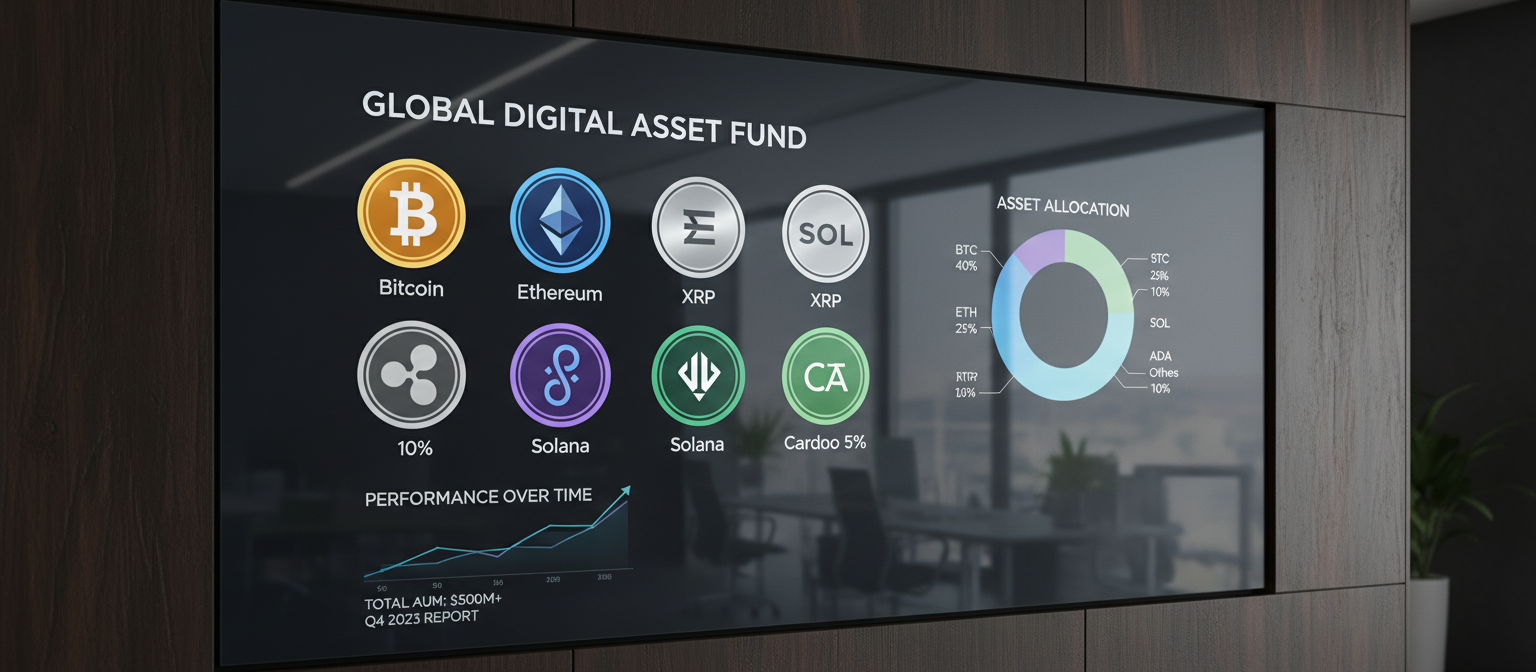

The fund bundles together the five largest and most liquid digital assets—Bitcoin, Ethereum, XRP, Solana, and Cardano—with approximately 70% allocated to Bitcoin and 20% to Ethereum. The CoinDesk 5 Index measures the performance of the largest and most liquid five digital assets, with constituents weighted by market capitalization and rebalanced quarterly.

Grayscale’s fund is set to uplist to NYSE Arca on September 19, 2025, marking a significant milestone as one of the first multi-asset cryptocurrency ETFs available to U.S. investors. The fund has already gained more than 40% in 2025 as many cryptocurrencies hit record highs, outpacing Bitcoin by nearly 11% since June.

Industry Reactions and Market Implications

The regulatory shift has generated enthusiastic responses across the cryptocurrency and traditional finance industries.

SEC Chairman Paul S. Atkins emphasized the decision’s strategic importance: “By approving these generic listing standards, we are ensuring that our capital markets remain the best place in the world to engage in the cutting-edge innovation of digital assets.”

James Seyffart, a prominent ETF analyst, predicted the decision would trigger “a wave of spot crypto ETP launches in coming weeks and months.” The streamlined approval process is expected to accelerate product development cycles and reduce the regulatory uncertainty that has previously deterred some issuers.

Kristin Smith of the Solana Policy Institute called the decision “a net-positive for U.S. investors, markets, and digital asset innovation,” highlighting the potential for expanded investment options and improved market access for retail and institutional investors alike.

Market participants are already positioning for what many expect to be a significant expansion of crypto investment products. With major issuers like Grayscale, Bitwise, 21Shares, and Canary Capital having already filed applications for various single-asset and multi-asset crypto ETFs, October 2025 is shaping up to feature a packed calendar of potential launches.

Looking Ahead: A New Era for Crypto Investment

The approval of generic listing standards represents a maturation of cryptocurrency regulation and a vote of confidence in the digital asset industry’s infrastructure and oversight mechanisms. By establishing clear, predictable pathways for crypto ETF listings, the SEC has addressed one of the industry’s most persistent regulatory bottlenecks.

For investors, the decision promises expanded choice and easier access to diversified cryptocurrency exposure through regulated, exchange-traded products. The elimination of prolonged approval timelines means that innovative products can reach the market faster, potentially keeping pace with the rapidly evolving cryptocurrency ecosystem.

As the industry watches October’s calendar fill with pending decisions on 16 altcoin ETF applications, the September 17 decision is already being recognized as a pivotal moment—one that could mark the beginning of a new chapter in mainstream cryptocurrency investment accessibility.

This article reflects information available as of September 18, 2025.