The competitive landscape between Ethereum and Solana is intensifying as new data reveals a significant shift in investment flows favoring the faster, more cost-effective blockchain platform. Recent analysis shows Solana attracting substantially more stablecoin inflows than Ethereum despite the latter’s massive market capitalization advantage, suggesting changing investor preferences in the evolving cryptocurrency ecosystem.

As of late January, Solana held nearly $11 billion in stablecoins on its chain, with a total market cap of $94.9 billion. In contrast, Ethereum maintained its dominant position with a market cap approaching $326 billion, but the inflow patterns tell a more nuanced story about where new capital is flowing.

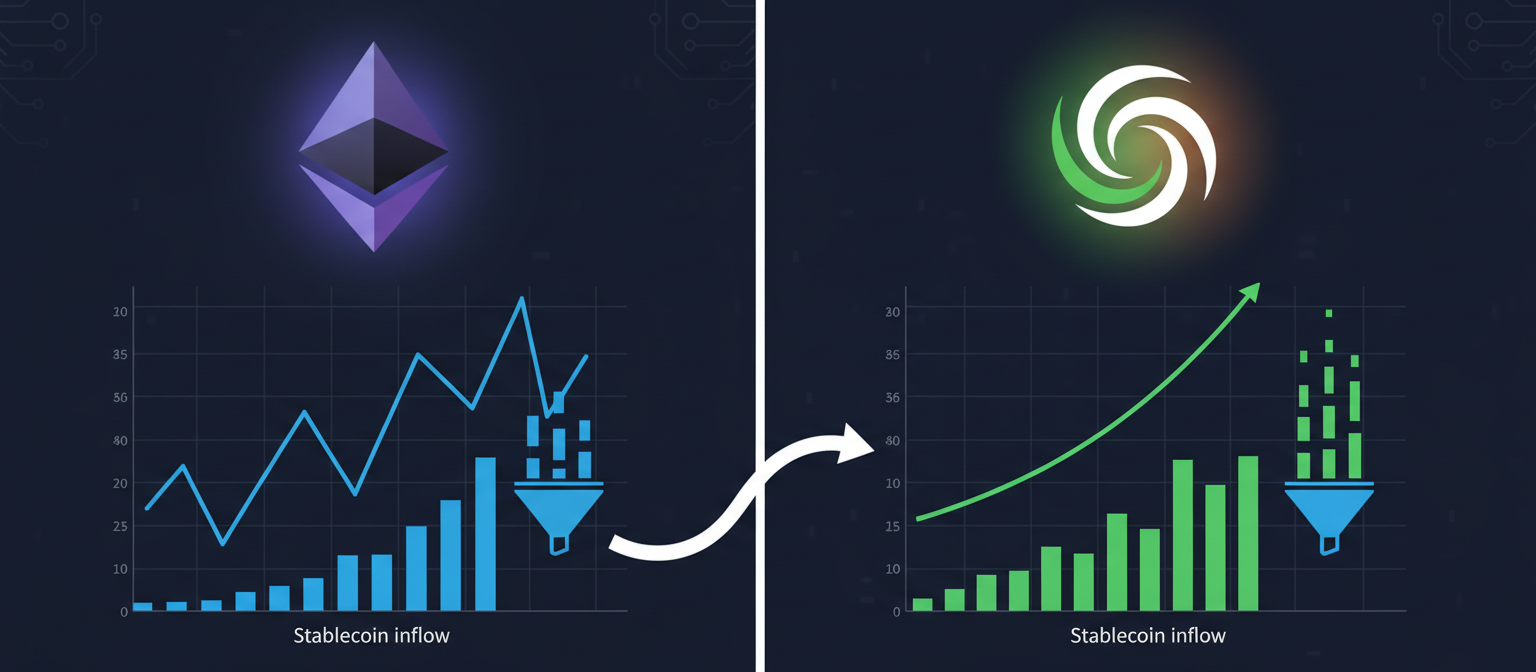

Stablecoin Inflows Reveal Shifting Sentiment

The most telling indicator of changing investor behavior comes from January’s stablecoin inflow data. Solana reported $5.3 billion in stablecoin inflows during January, significantly outpacing Ethereum’s $4.3 billion despite Ethereum having more than three times the market capitalization.

This disparity is particularly noteworthy because stablecoins serve as a direct measure of new capital entering blockchain ecosystems. Unlike exchange-traded fund investments, which live in traditional financial markets, stablecoin inflows represent money moving directly onto the blockchain networks where cryptocurrencies actually operate.

The data suggests that investors are increasingly choosing to deploy their capital on Solana’s network rather than Ethereum’s, potentially due to Solana’s advantages in transaction speed and cost efficiency. This trend could have significant implications for both platforms’ long-term growth trajectories.

Technical Performance Comparison

The competitive dynamics between Ethereum and Solana can be understood through their fundamental technical differences. Ethereum, while maintaining its position as the second-largest cryptocurrency by market capitalization, has faced persistent criticism regarding slow transaction times and high gas fees that have plagued users for years.

Solana, on the other hand, has positioned itself as a faster and cheaper alternative while offering most of the same smart contract functionality and maintaining a rapidly growing ecosystem of projects. This value proposition appears to be resonating with users and developers seeking alternatives to Ethereum’s congestion and cost issues.

The performance data over recent months supports this narrative. Solana’s price has gained significant ground while Ethereum has struggled, reflecting market participants’ voting with their capital on which platform offers better utility and user experience.

Three-Year Performance Trends

Looking at longer-term performance patterns reveals even more striking trends. Over the past three years, Solana’s price has increased by 105%, while Ethereum’s has declined by 11%. This divergence suggests that the market is increasingly rewarding Solana’s approach to blockchain scaling and user experience.

The sustained outperformance of Solana relative to Ethereum indicates that the current trend may not be temporary but rather represents a fundamental shift in how investors and users are evaluating blockchain platforms. The complaints about Ethereum’s technical limitations appear to be reaching a tipping point where affected users are actively migrating to alternatives.

Capital Migration Patterns

The movement of capital from Ethereum to Solana represents more than just price action; it signifies a migration of users, developers, and projects seeking better technical infrastructure. This migration is particularly concerning for Ethereum because it affects not just speculation but actual usage and ecosystem development.

When investors move stablecoins onto a blockchain, they’re positioning themselves to participate in that ecosystem’s applications, services, and financial activities. The choice to move to Solana rather than Ethereum suggests that users find more compelling opportunities or better user experiences on the Solana network.

This capital migration could create a self-reinforcing cycle where increased activity on Solana attracts more developers and projects, which in turn draws more users and capital, potentially accelerating Ethereum’s relative decline if the trend continues unchecked.

Investment Strategy Implications

For investors navigating this evolving landscape, the changing dynamics between Ethereum and Solana present several strategic considerations. The first approach would be to position investments to capture the ongoing migration of capital from Ethereum to Solana’s network, assuming current trends persist.

A $1,500 investment allocation could be used to participate in this trend, with the understanding that Solana’s technological advantages and growing ecosystem adoption could continue to drive outperformance. The rationale is that unless Ethereum implements significant protocol improvements or undergoes major technological upgrades, its current issues are likely to persist.

However, contrarian investors might consider Ethereum a potential turnaround play. The Ethereum Foundation is experiencing new leadership, which could lead to significant changes in development priorities and execution. This governance shift could eventually address the platform’s technical limitations, potentially reversing the current negative trend.

Future Catalysts and Considerations

Looking ahead, several factors could influence the competitive dynamics between these two platforms. For Solana, continued ecosystem growth, successful scaling solutions, and the rollout of new applications like AI agent infrastructure projects could further solidify its competitive advantage.

For Ethereum, successful implementation of protocol upgrades, resolution of gas fee issues, and improvements in transaction speed could help stem the outflow of capital to competitors. The platform’s established network effects and extensive developer community remain significant advantages that shouldn’t be underestimated.

The outcome of this competition could significantly impact the broader cryptocurrency landscape. If Solana continues to gain market share, it could challenge Ethereum’s position as the leading smart contract platform. Conversely, if Ethereum successfully addresses its technical issues, it could maintain its dominance and potentially attract back capital that has migrated to competing platforms.

Market Position and Long-Term Outlook

Despite current trends favoring Solana, it’s important to maintain perspective on both platforms’ relative positions in the broader cryptocurrency ecosystem. Ethereum maintains substantial advantages in network effects, developer community, and institutional adoption that could prove resilient over the long term.

Solana’s rise represents the competitive nature of the cryptocurrency market, where technological innovation and user experience can rapidly shift market dynamics. This competition ultimately benefits users by driving improvements across all platforms and ensuring that no single network can become complacent.

For investors, the key is to monitor not just price movements but the underlying metrics that indicate ecosystem health and user adoption. Stablecoin inflows, developer activity, and transaction volumes provide more meaningful insights into which platforms are gaining traction than short-term price fluctuations alone.

Strategic Portfolio Considerations

Investors considering exposure to this competitive dynamic should weigh their risk tolerance and investment timeline. For those with shorter time horizons, the current momentum favors Solana, making it the more straightforward investment choice based on existing trends.

Long-term investors might consider a more balanced approach, recognizing that both platforms could play important roles in the evolving cryptocurrency landscape. Ethereum’s established position and potential for protocol improvements could make it an attractive recovery play, while Solana’s technological advantages and growth momentum provide compelling growth potential.

The $1,500 investment threshold mentioned in market analysis provides sufficient exposure to participate in these trends while maintaining appropriate risk management. Investors should consider their overall portfolio allocation and risk tolerance when determining their exposure to either platform or both.

This article reflects information available as of February 16, 2025. Market conditions, competitive dynamics, and investment considerations may have evolved since publication.