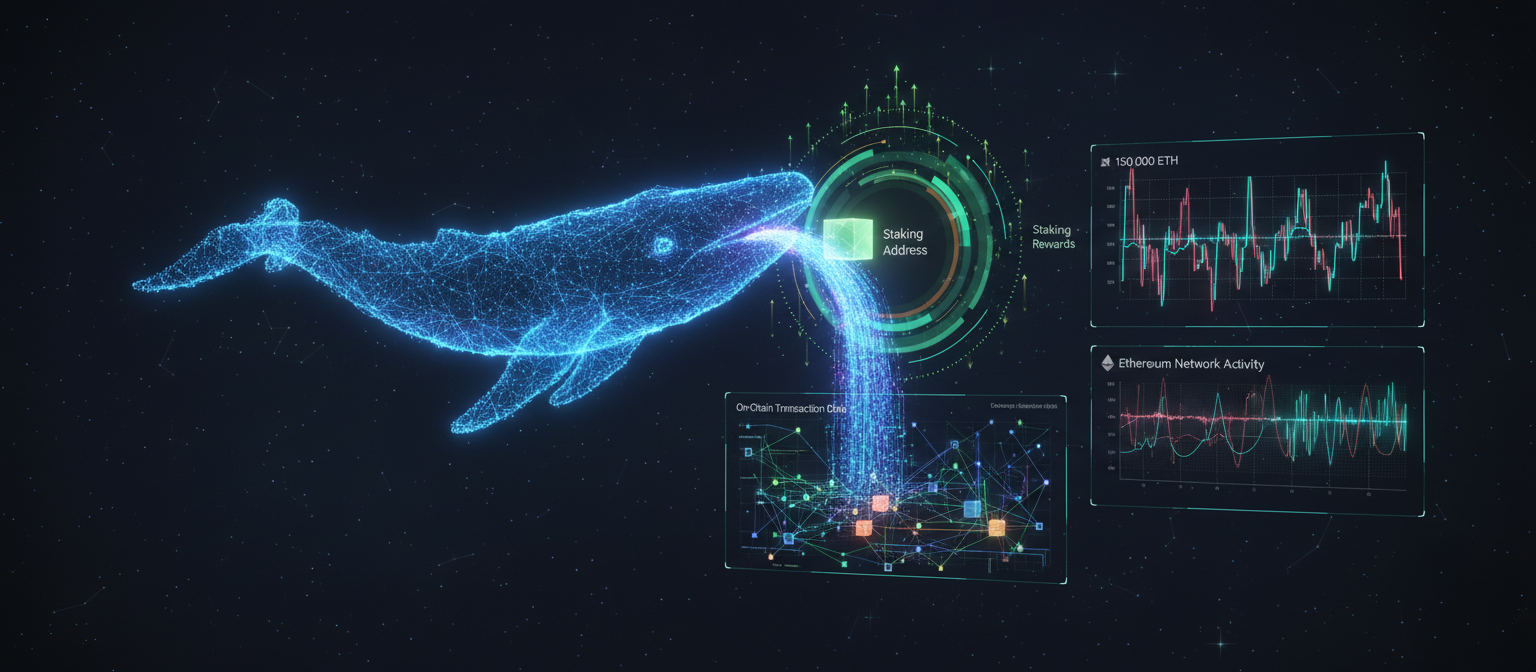

In a stunning display of long-term confidence in Ethereum’s staking ecosystem, a previously dormant Ethereum ICO participant moved 150,000 ETH worth approximately $646 million to a staking address yesterday evening, according to on-chain data from EmberCN.

The movement from three addresses that hadn’t shown activity since February 2022 marks one of the largest single staking deposits in recent memory and signals growing bullish sentiment among Ethereum’s earliest investors.

The Movement by the Numbers

The transaction involved three separate addresses that all participated in Ethereum’s initial coin offering (ICO) between July 22 and September 2, 2014. These addresses collectively transferred 150,000 ETH to a single staking address, representing one of the most significant whale movements in recent Ethereum history.

What makes this movement particularly noteworthy is the three-year dormancy period preceding it. The addresses were last active in February 2022, and their transactions at that time were unrelated to ether holdings. The sudden reemergence and immediate staking deployment suggests a calculated strategic decision rather than panicked selling.

The timing is especially significant given Ethereum’s current trading levels. At $4,331 per ETH, this represents a substantial increase from the original ICO price of $0.31 per ETH, translating to returns of over 1.3 million percent for the original investment.

Growing Pattern of ICO Whale Activity

This isn’t an isolated incident. Several Ethereum ICO participants have recently resurfaced, moving their substantial holdings amid growing optimism around ether’s price trajectory and staking ecosystem.

Just last month, another Ethereum ICO participant transferred approximately $19 million worth of ETH to Kraken exchange, subsequently selling 1,060 ETH in the following days. Additionally, a separate ICO address was identified sending 2,300 ETH (worth about $10 million) to Kraken for liquidation purposes.

However, the current movement differs significantly—rather than moving to exchanges for potential selling, this whale chose to stake their ETH, demonstrating confidence in Ethereum’s long-term value proposition and the security of its proof-of-stake consensus mechanism.

Staking Economics and Market Impact

The decision to stake such a substantial amount of ETH has significant implications for Ethereum’s network security and token economics. With 150,000 ETH now committed to staking, this represents roughly 0.13% of Ethereum’s total supply being locked in the network’s security mechanism.

At current staking rewards rates of approximately 3-4% annually, this position could generate between $19-25 million in passive rewards per year, assuming current ETH prices and reward rates remain stable.

The movement also contributes to Ethereum’s ongoing deflationary pressure. By removing 150,000 ETH from circulating supply and placing it in staking, the effective circulating supply decreases, potentially supporting price levels during periods of high demand.

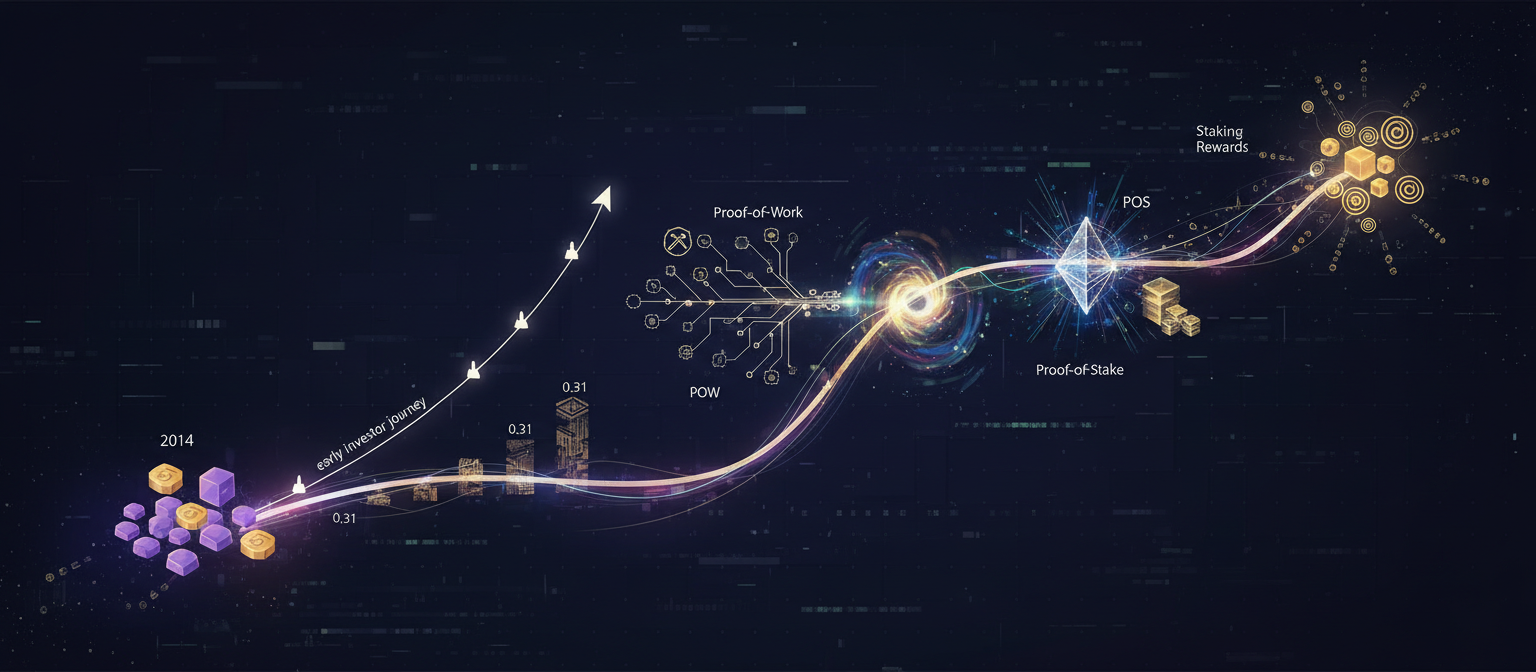

Historical Context of ICO Investments

To understand the significance of this movement, it’s worth recalling the context of Ethereum’s ICO. Held in the summer of 2014, the ICO raised approximately $18.3 million by selling over 60 million ETH tokens at an average price of $0.31 per ETH.

The fact that these original participants have held through multiple market cycles—including the 2018 bear market, the 2020 DeFi summer, the 2021 bull run, and the 2022-2023 bear market—demonstrates remarkable conviction in Ethereum’s long-term vision.

The transition to staking rather than selling suggests these early believers see continued upside potential in Ethereum’s future development and adoption trajectory.

Market Reaction and Broader Implications

Ethereum’s price reaction to this news has been relatively muted, with ETH trading down approximately 1% in the past 24 hours to $4,331. Meanwhile, Bitcoin showed slight strength, climbing 0.7% to $111,519.

The measured market response suggests that investors view this movement as fundamentally positive rather than alarming. The choice to stake rather than sell eliminates immediate sell pressure on the market, instead contributing to network security and long-term holder confidence.

This movement also highlights the maturation of Ethereum’s ecosystem. In earlier market cycles, large whale movements often triggered panic selling and price volatility. Today, the infrastructure exists to handle substantial movements efficiently, and the market has developed sufficient depth to absorb such transactions without significant disruption.

Looking Ahead: What This Signals for Ethereum

The staking movement from this ICO whale may serve as a bellwether for other long-term holders considering their options. As Ethereum continues to develop its scaling solutions, maintain network security, and expand its use cases in DeFi, NFTs, and enterprise applications, early investors appear increasingly confident in the network’s long-term viability.

The fact that original ICO participants are choosing to stake rather than liquidate their positions suggests they believe Ethereum’s best days may still be ahead, despite already generating returns exceeding 1,000,000% from their initial investments.

For the broader cryptocurrency market, this movement reinforces the narrative of maturation and institutionalization. Large holders are increasingly sophisticated in their strategies, utilizing advanced tools like staking to maximize returns while contributing to network security rather than simply cashing out.

This article reflects information available as of September 5, 2025. Market conditions and data points may have changed since publication.