Ethereum took a major step toward enhanced scalability this week with the successful deployment of its Fusaka upgrade on the Holesky testnet on October 2, 2025. The milestone triggered immediate market enthusiasm, with ETH surging over 5% to break through the $4,300 price level.

The testnet launch marks the beginning of a carefully orchestrated rollout that will culminate in mainnet deployment on December 3, 2025, potentially transforming Ethereum’s capacity to handle transactions at scale.

What Is the Fusaka Upgrade?

Fusaka represents one of Ethereum’s most ambitious technical upgrades to date, incorporating 12 Ethereum Improvement Proposals (EIPs) designed to dramatically enhance network efficiency and reduce costs for users and businesses.

At the heart of Fusaka lies PeerDAS (Peer Data Availability Sampling), introduced through EIP-7594. This innovative technique allows validators to verify transactions without downloading entire rollup data blobs—a game-changing improvement for network resource efficiency.

According to technical projections, PeerDAS could enable Ethereum to theoretically process up to 12,000 transactions per second by 2026, compared to current throughput levels. The upgrade also includes a gas limit increase from around 45 million units, eventually scaling toward 150 million units, allowing more transactions per block.

Testnet Rollout Schedule

The Fusaka upgrade follows a methodical deployment strategy across Ethereum’s test networks before reaching mainnet:

- Holesky testnet: October 2, 2025 ✓ (completed)

- Sepolia testnet: October 14, 2025

- Hoodi testnet: October 28, 2025

- Mainnet deployment: December 3, 2025

“Holesky is done!” declared Parithosh Jayanthi, a DevOps developer at the Ethereum Foundation, following the successful testnet activation. “This is a great first step toward Fusaka on the mainnet and more blobs on Ethereum.”

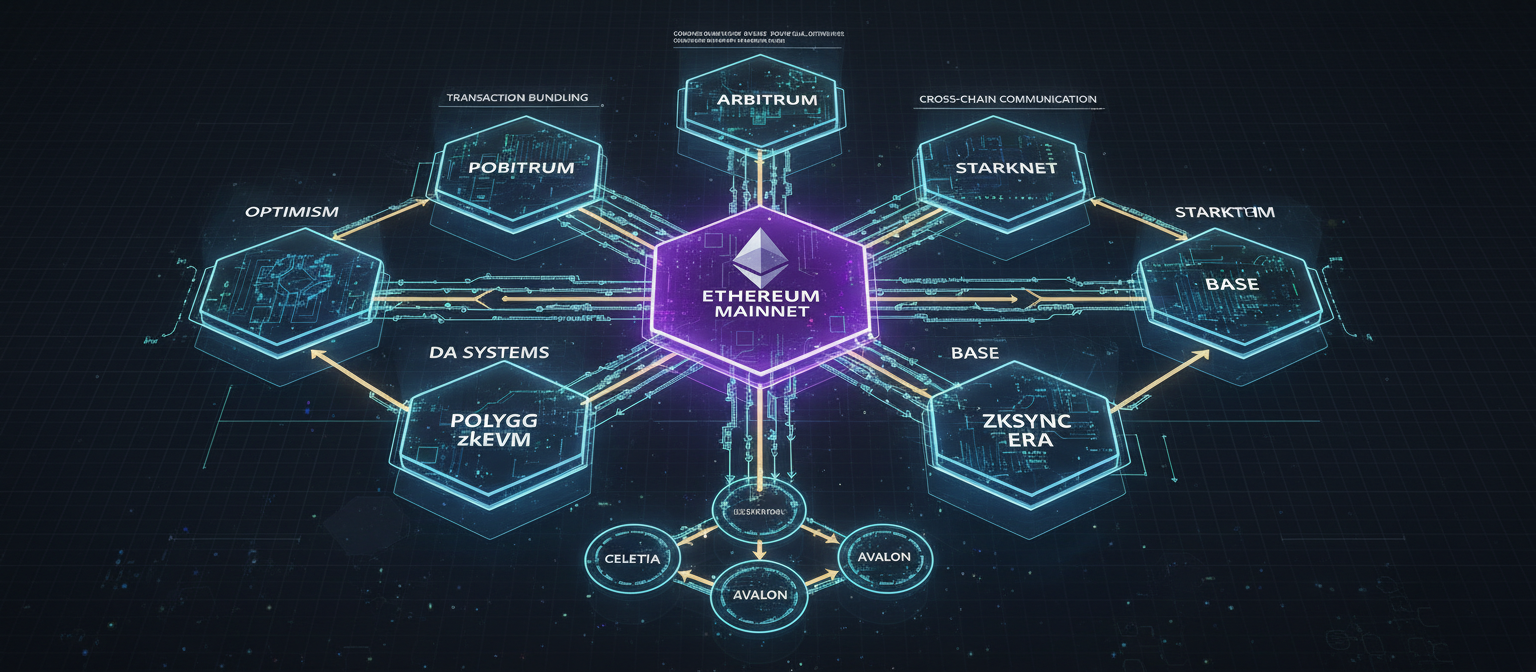

Massive Scalability Gains for Layer 2 Networks

The Fusaka upgrade delivers particularly impressive benefits for Ethereum’s Layer 2 ecosystem. By implementing PeerDAS, node data storage requirements will be reduced by 87.5%, while simultaneously enabling an 8x throughput boost for Layer 2 solutions.

This dual benefit—lower storage needs and higher transaction capacity—addresses two critical bottlenecks that have limited Ethereum’s scalability. Layer 2 networks like Arbitrum, Optimism, and Base stand to gain significantly from these improvements, enabling them to process dramatically more transactions at lower costs.

For users, this translates to faster transaction confirmations and reduced fees, particularly for complex DeFi operations and high-frequency trading activities conducted on Layer 2 platforms.

Market Response: ETH Breaks $4,300

The successful Holesky testnet launch generated immediate positive momentum in crypto markets. Ethereum’s price jumped over 5% to surpass $4,300, with some analysts projecting further upside if ETH can break through the $4,400 resistance level.

The price movement reflects growing confidence among investors that Ethereum is successfully executing its technical roadmap. Market analysts suggest that if ETH sustains momentum above the $4,300-$4,320 resistance cluster, a move toward $4,800-$5,000 becomes increasingly likely in October 2025.

Current price action positions Ethereum near $4,472, with predictions pointing to a potential breakout above $4,500 that could target the $4,600-$4,800 range in the near term.

Institutional Adoption Accelerates

Beyond technical upgrades, Ethereum is experiencing heightened institutional interest. SWIFT, the global financial messaging network, recently announced a partnership involving an Ethereum Layer 2 solution, signaling serious enterprise adoption of Ethereum infrastructure.

Additionally, filings for a Lido Staked ETH ETF could potentially channel significant institutional capital into ETH staking, further strengthening Ethereum’s ecosystem and creating new demand dynamics for the asset.

What This Means for Ethereum’s Future

The Fusaka upgrade represents a critical phase in Ethereum’s evolution from a congested network to a high-performance platform capable of supporting global-scale applications. The combination of reduced resource requirements and dramatically increased transaction throughput positions Ethereum to compete more effectively with alternative Layer 1 blockchains that have prioritized speed and low costs.

For developers building on Ethereum, the upgrade promises a more sustainable foundation for decentralized applications. The 87.5% reduction in node storage requirements could enable more participants to run validators, enhancing network decentralization while the throughput improvements support more complex applications.

The upcoming testnet deployments on Sepolia and Hoodi will provide additional opportunities to stress-test the upgrade before the critical December 3 mainnet launch. If successful, Fusaka could mark a turning point in Ethereum’s journey toward becoming the settlement layer for a multi-chain future, with Layer 2 networks handling billions of transactions while maintaining security guarantees from Ethereum’s base layer.

As the crypto community watches the remaining testnet activations unfold through October, one thing is clear: Ethereum is positioning itself for a scalability breakthrough that could redefine what’s possible on the world’s leading smart contract platform.