As Ethereum trades around $2,800 in mid-2025, investors are wondering whether a modest $2,000 investment today could grow to $10,000 by 2030. The fivefold gain required represents an ambitious but potentially achievable target for the world’s second-largest cryptocurrency.

The analysis requires examining both the tailwinds propelling Ethereum forward and the headwinds that could stall its momentum over the next five years.

Recent Catalysts Building Momentum

Ethereum’s fundamentals have strengthened significantly in 2025, providing multiple catalysts that could support substantial price appreciation. The most significant development was the successful deployment of the Pectra upgrade on May 7, 2025, which has already demonstrated tangible improvements to network performance.

The Pectra upgrade was designed to enable the chain to operate faster and cheaper while delivering a smoother user experience. Early results show the upgrade has successfully slashed average confirmation times and paved the way for account abstraction features that make Ethereum wallets feel more like mainstream fintech applications. This reduction in friction could help retain developers and users who might otherwise migrate to faster rival networks.

Capital inflows present another bullish indicator. U.S. spot Ethereum ETFs demonstrated strong demand during a 14-session inflow streak that ended on June 6, marking the longest such run of 2025. These ETFs vacuumed up $812 million during this period, reflecting growing institutional appetite for Ethereum exposure.

The on-chain data tells an even more compelling story. Net on-chain inflows have totaled approximately $8.5 billion so far in 2025, completely reversing 2024’s net outflow trend. This sustained demand takes coins off centralized exchanges, constricting the available supply for immediate sale and hardening price floors.

Ethereum’s Economic Moat Deepens

Perhaps Ethereum’s most compelling advantage lies in its unrivaled position as the primary hub for stablecoins. The network hosts approximately 55% of all stablecoin value in the cryptocurrency sector, representing about $131 billion in capital.

These stablecoin holdings represent sticky capital that anchors economic activity on the network. More importantly, this capital generates consistent fee revenue for Ethereum validators through staking, creating a sustainable economic foundation for the network.

The combination of enforced scarcity through token burns and rising non-speculative demand creates a reliable recipe for long-term price pressure to the upside. Unlike purely speculative assets, Ethereum derives value from its role as critical financial infrastructure supporting billions in economic activity.

The network’s established user base and developer ecosystem provide additional defensibility. Despite competition from newer, faster blockchains, Ethereum remains the default platform for many decentralized applications, particularly those requiring maximum security and decentralization.

Competitive Challenges Intensify

While Ethereum’s fundamentals are strengthening, the competitive landscape continues to evolve rapidly. Rival smart contract chains are consistently chipping away at Ethereum’s user growth and developer base by offering lower fees and faster transaction times.

Solana, in particular, has emerged as a formidable competitor, attracting developers who prioritize cost and speed over Ethereum’s security pedigree. Various Layer 2 rollups also compete for developer attention, potentially fragmenting the ecosystem that has historically benefited Ethereum.

The competitive pressure becomes particularly concerning in emerging growth sectors like artificial intelligence and gaming. Should a competing ecosystem establish dominance in these high-growth areas, capital could flow out of Ethereum faster than ETFs can pull it in.

Developer retention remains a critical challenge. While the Pectra upgrade has improved user experience, Ethereum still faces difficulties in keeping developers who prioritize immediate performance over network effects and security.

Macroeconomic Headwinds Loom

The macroeconomic environment presents another significant challenge to Ethereum’s growth trajectory. If the Federal Reserve needs to tighten interest rates again to combat inflation, potentially caused by tariff policies, liquidity could dry up just as quickly as it returned to risk assets.

Liquidity droughts typically punish risky assets first, and cryptocurrencies often experience the most severe volatility during market stress. A higher interest rate environment would make risk-free investments more attractive, potentially drawing capital away from speculative assets like Ethereum.

The timing of these macroeconomic shifts could prove crucial. A liquidity crunch during Ethereum’s development cycle could severely impact its ability to achieve the sustained growth needed for a fivefold price increase.

Regulatory Uncertainty Persists

Although the Securities and Exchange Commission finally approved Ethereum ETFs in 2024, significant regulatory uncertainty remains. Congress has yet to establish a comprehensive legal framework for staking yields or many DeFi products that are essential to Ethereum’s ecosystem.

A heavy-handed regulatory approach could severely limit on-chain activity, potentially undermining the very value proposition that makes Ethereum attractive. The lack of clear rules around staking, in particular, creates uncertainty for institutional investors who need regulatory clarity before committing significant capital.

The regulatory landscape could evolve in either direction over the next five years, making this a significant variable in Ethereum’s growth equation. Favorable regulations could accelerate institutional adoption, while restrictive measures could impede ecosystem development.

Mathematical Realities of 5X Growth

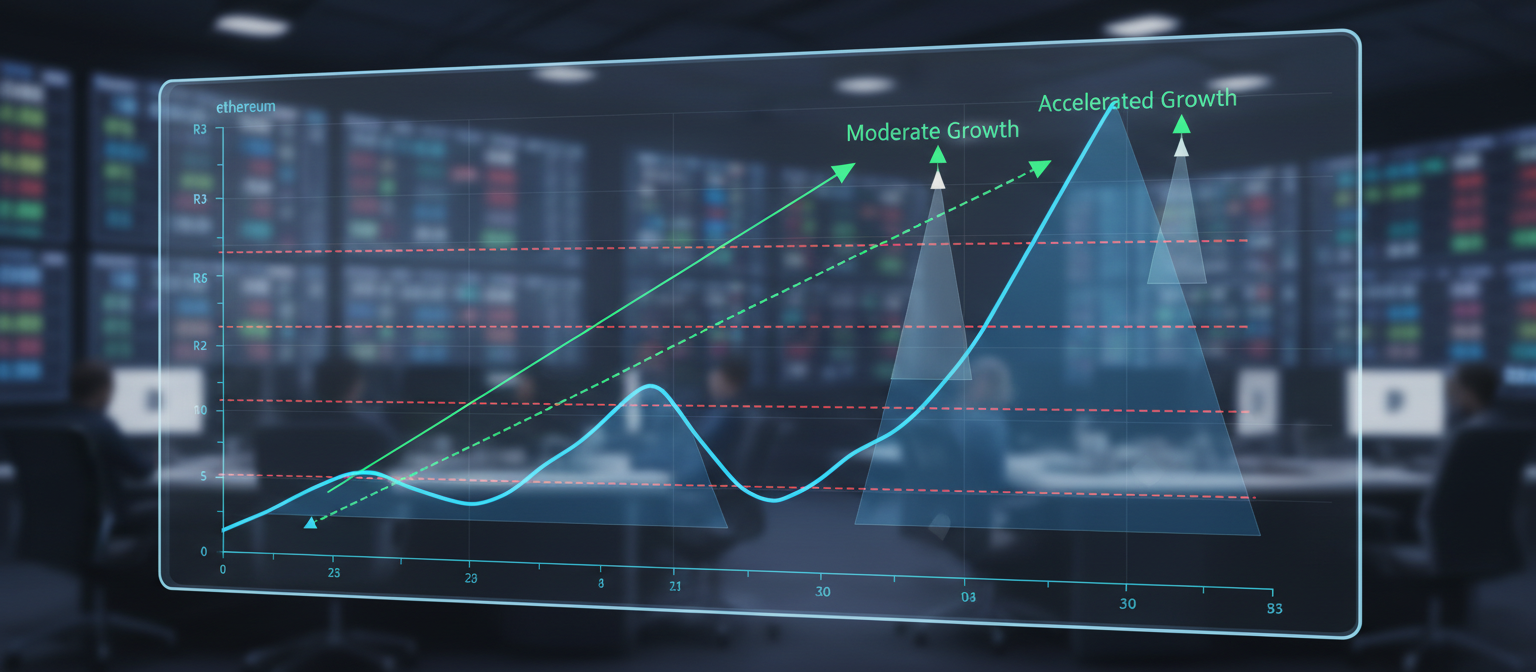

To reach the $13,300 price level required for a $2,000 investment to become $10,000, Ethereum must achieve a compound annual growth rate (CAGR) of approximately 35% through 2030. This represents an ambitious target that would require uninterrupted growth across multiple metrics.

Sustaining such a rapid growth rate will demand continuous expansion in user adoption, fee revenue, and market narrative. Ethereum would need to maintain its technological edge while fending off competitive threats from both established rivals and emerging technologies.

The mathematical challenge becomes even more daunting when considering Ethereum’s already substantial market capitalization. As the second-largest cryptocurrency, each percentage point of growth requires increasingly large capital inflows compared to smaller, nimbler competitors.

However, Ethereum’s established position as critical financial infrastructure provides a foundation that many smaller projects lack. The network’s role in supporting billions in economic activity could justify sustained investment flows, particularly if the broader cryptocurrency market continues to mature.

Investment Considerations and Risk Factors

For investors considering Ethereum as a potential 5x investment, several factors merit careful consideration. The cryptocurrency’s volatility remains substantial, with price swings of 20% or more not uncommon during market stress.

The investment timeline is also crucial. Ethereum’s path to $13,300 by 2030 would likely not be linear, with significant drawdowns and consolidation periods along the way. Investors would need to withstand substantial volatility without panic selling.

Diversification remains important despite Ethereum’s strong fundamentals. The competitive landscape evolves rapidly, and technological breakthroughs could emerge from unexpected sources. Overconcentration in a single cryptocurrency, even Ethereum, represents significant risk.

The regulatory environment could change dramatically, either supporting or hindering Ethereum’s growth trajectory. Investors should monitor legislative developments and regulatory guidance closely, particularly around staking and DeFi products.

Conclusion: Ambitious But Not Impossible

The path from $2,800 to $13,300 by 2030 represents a challenging but potentially achievable goal for Ethereum. The network’s strengthening fundamentals, improving technology, and growing institutional adoption provide solid foundation for growth.

However, investors should temper expectations and recognize the substantial challenges ahead. Competition from rival blockchains, macroeconomic uncertainty, and regulatory risks all present significant headwinds that could impede Ethereum’s progress.

For investors with a high-risk tolerance and long time horizon, Ethereum offers compelling potential returns supported by real economic utility. The network’s role as financial infrastructure, combined with its technological improvements and growing institutional adoption, provides multiple potential paths to value appreciation.

The odds of achieving a fivefold return by 2030 appear moderate rather than high, but the potential upside could justify a measured position for investors who can withstand volatility and maintain a long-term perspective through inevitable market cycles.

This article was published on July 12, 2025, and reflects information available as of that date.