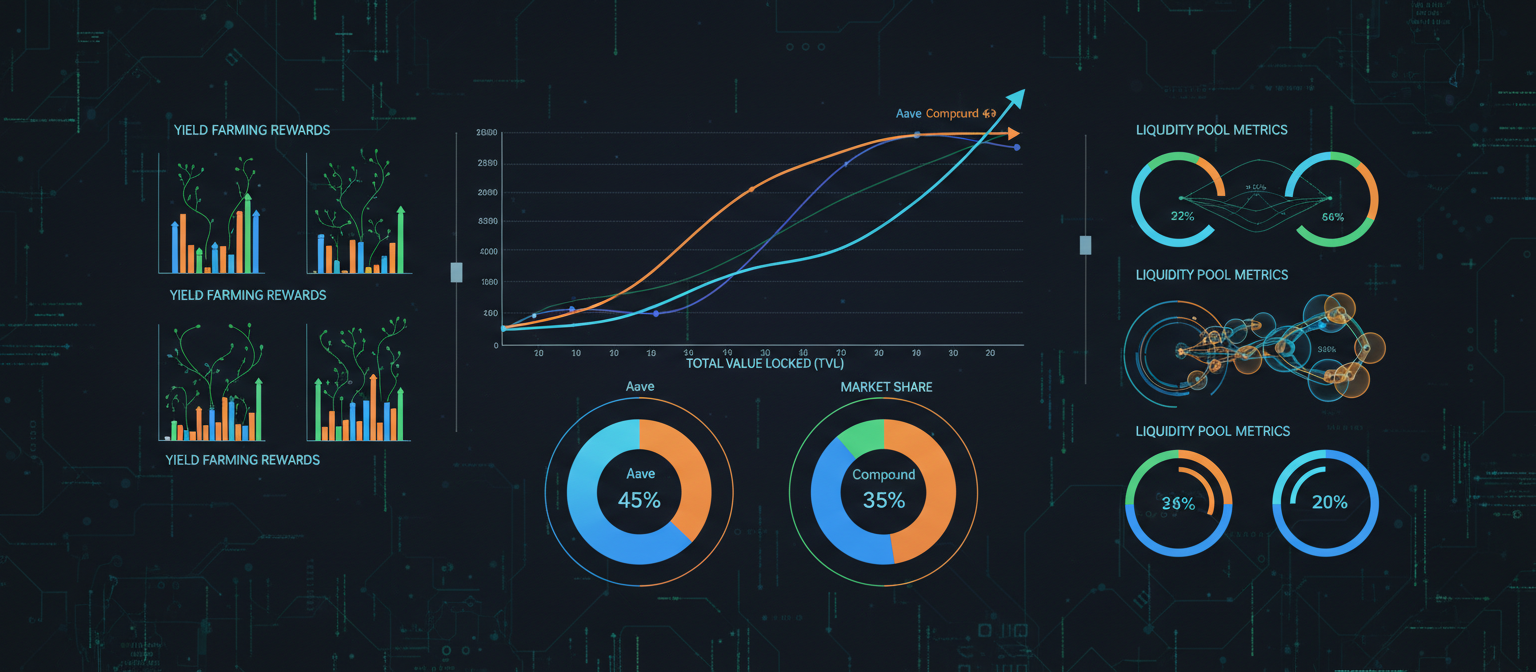

The decentralized finance lending market has reached a significant milestone, with Total Value Locked (TVL) in crypto lending protocols surpassing $56 billion, representing 35% of the total DeFi ecosystem. This remarkable growth demonstrates the increasing sophistication and adoption of DeFi lending solutions as both retail and institutional users seek yield opportunities in the digital asset space.

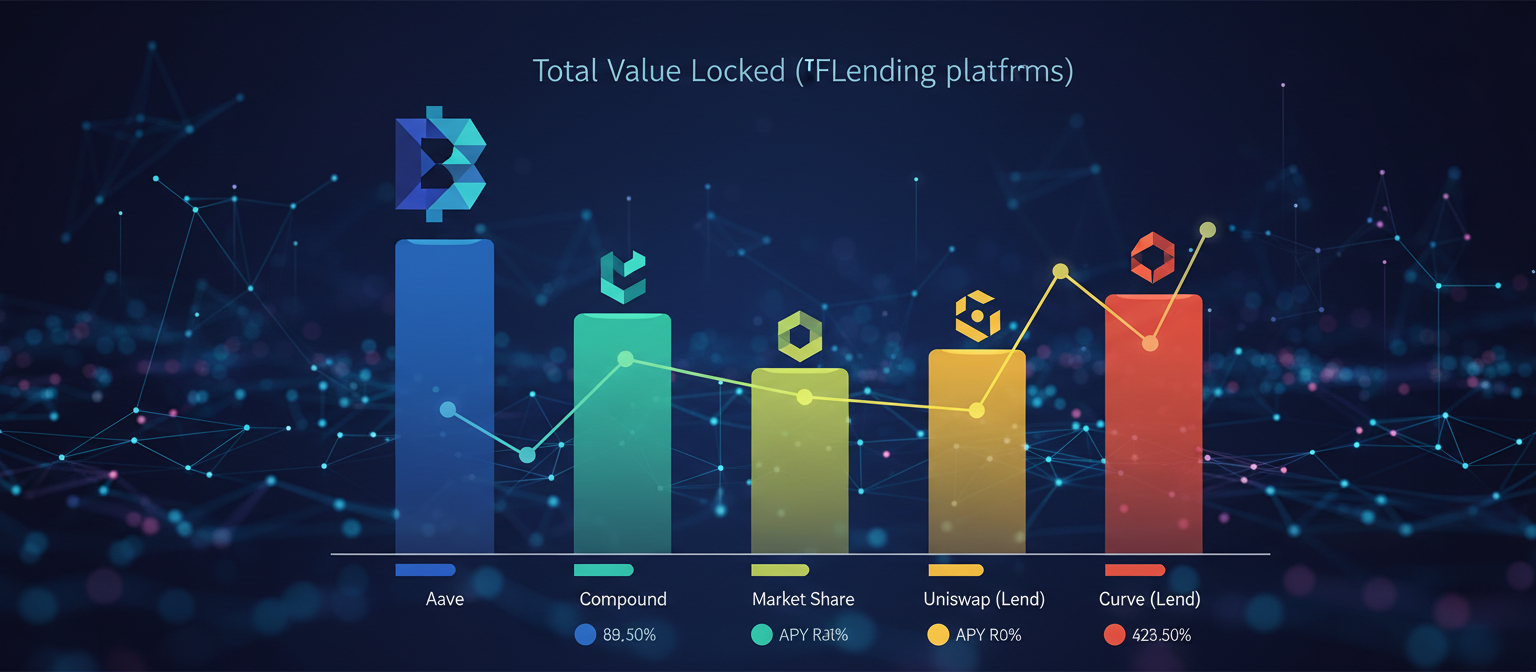

Leading platforms Aave and Compound continue to dominate the lending landscape, accounting for nearly 60% of the total lending TVL between them. This consolidation of market share among established protocols reflects growing user confidence in battle-tested platforms with proven track records of security and reliability.

Market Growth Drivers

Several factors are contributing to the explosive growth in DeFi lending:

Institutional Interest: DeFi platforms have seen a 27.44% growth in lending activity compared to the previous quarter, driven by increased institutional participation. Professional investors are increasingly drawn to the higher yields available in DeFi compared to traditional finance options.

Regulatory Clarity: Improved regulatory frameworks in key jurisdictions have made institutions more comfortable with DeFi exposure. The approval of various crypto ETFs and clearer guidelines around digital asset custody have paved the way for greater institutional capital allocation.

Product Sophistication: DeFi lending protocols have evolved to offer more sophisticated products, including flash loans, variable interest rate mechanisms, and cross-chain lending capabilities. These innovations attract more sophisticated users and larger capital deployments.

Yield Optimization: With traditional finance offering historically low interest rates, DeFi lending continues to provide attractive yield opportunities. Users can earn 10-20% APY on various assets, significantly outperforming conventional savings products.

Platform Performance and Competition

Aave maintains its position as the leading DeFi lending protocol with over $23 billion in TVL. The platform’s success is attributed to its innovative features, including flash loans with minimal 0.09% fees and support for over 14 different blockchain networks. Aave token holders enjoy additional benefits such as zero-fee transactions and governance participation.

Compound follows closely behind, offering competitive interest rates around 10% and supporting over 10 blockchain networks. The platform’s cToken system provides users with interest-bearing tokens that represent their lending positions, creating a seamless experience for both new and experienced DeFi users.

Other notable platforms gaining traction include specialized lending protocols that focus on specific market segments or unique value propositions:

- Yield Protocol: Mobile-friendly platform offering up to 20% APY on USDC and USDT

- Uniswap: While primarily known as a DEX, its lending features have gained popularity

- Emerging Cross-chain Solutions: New protocols enabling lending across multiple blockchains

Interest Rate Dynamics

DeFi lending rates have remained attractive despite the influx of capital, thanks to strong demand for borrowing across the ecosystem. Current rates across major platforms include:

- Aave: Variable rates typically ranging from 10-20%, with additional benefits for AAVE token holders

- Compound: Stable rates around 10%, with cToken rewards and governance participation

- Yield: Premium rates of up to 20% on stablecoins like USDC and USDT

- Specialized Platforms: Rates ranging from 12-25% depending on asset type and platform

The rate structure is dynamic, responding to supply and demand fluctuations within each protocol. When borrowing demand increases, rates rise to attract more lenders, while decreased demand leads to lower rates. This market-based approach ensures efficient capital allocation across the ecosystem.

Risk Management and Security

As the DeFi lending market grows, so does the importance of robust risk management practices. Leading platforms have implemented sophisticated security measures including:

Smart Contract Audits: Regular security audits by reputable firms to identify and address potential vulnerabilities Insurance Coverage: Integration with insurance protocols to protect against potential losses Over-collateralization: Most loans require over-collateralization, typically 150-200% of the borrowed amount Liquidation Mechanisms: Automated liquidation systems to protect lenders from default risk

The emphasis on security has helped build user confidence in DeFi lending platforms, contributing to the industry’s growth. However, users are reminded that DeFi lending still carries risks, including smart contract vulnerabilities, market volatility, and liquidation risks.

Institutional Adoption Trends

Institutional adoption of DeFi lending has accelerated in 2025, with several notable trends:

Corporate Treasury Management: Companies are allocating portions of their treasury to DeFi lending protocols to generate yield on idle cash Asset Manager Integration: Traditional asset managers are creating products that provide exposure to DeFi lending yields Compliance Solutions: New services are emerging to help institutions meet regulatory requirements while accessing DeFi opportunities Custody Solutions: Institutional-grade custody solutions are making it easier for large organizations to participate in DeFi

These developments are bridging the gap between traditional finance and DeFi, bringing more sophisticated capital and expertise to the ecosystem.

Cross-Chain Expansion

DeFi lending protocols are increasingly expanding beyond Ethereum to support multiple blockchains. This multi-chain approach offers several benefits:

Lower Transaction Costs: Alternative blockchains often offer lower gas fees than Ethereum Higher Throughput: Some networks can process more transactions per second Access to Different User Bases: Each blockchain has its own community and user demographics Risk Diversification: Users can diversify across multiple ecosystems

Aave’s support for over 14 blockchains and Compound’s presence on 10+ networks exemplify this trend. Cross-chain composability is becoming increasingly sophisticated, enabling users to move assets and positions across different ecosystems seamlessly.

Future Outlook

The future of DeFi lending looks promising, with several developments on the horizon:

Real-World Asset Integration: Tokenization of real-world assets could dramatically expand the DeFi lending market Advanced Risk Management: More sophisticated risk modeling and insurance products Regulatory Compliance: Increased regulatory clarity could drive further institutional adoption Artificial Intelligence Integration: AI-powered lending protocols could optimize risk assessment and pricing

As the DeFi lending ecosystem continues to mature, it’s likely to play an increasingly important role in the broader financial system, offering competitive alternatives to traditional lending and borrowing options.

This analysis reflects DeFi lending market conditions as of June 10, 2025. Market dynamics and platform performance may have evolved since this publication.