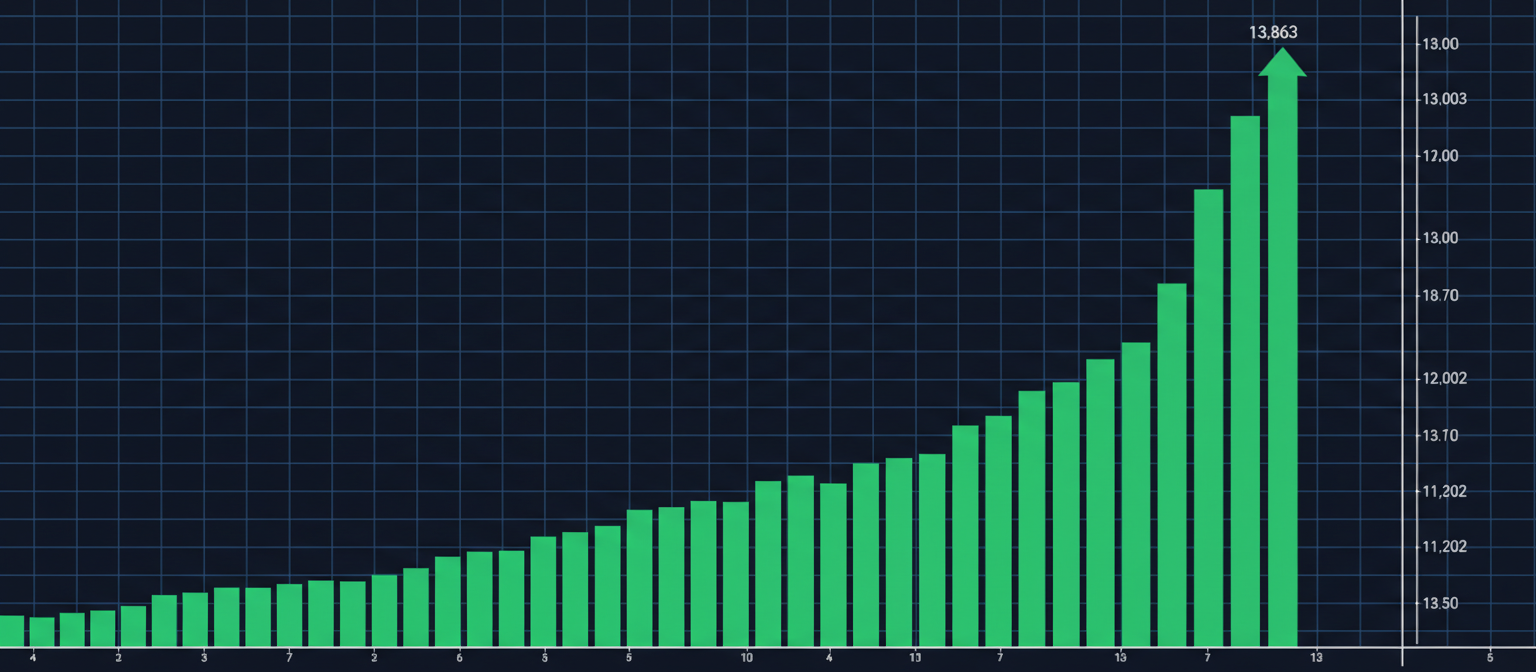

Bitcoin has surged to a new all-time high above $113,000, building on Wednesday’s record as investors flocked back to risk assets and massive short liquidations fueled the upward momentum. The flagship cryptocurrency climbed approximately 2% to reach $113,459.16, after hitting an intraday peak of $113,863.18 earlier today.

The rally represents a significant breakout from Bitcoin’s recent trading range, which had kept the cryptocurrency relatively contained for several weeks despite substantial institutional inflows. Today’s price action suggests a decisive shift in market sentiment as risk appetite returns to both traditional and cryptocurrency markets.

Short Squeeze Catalyst

A key driver behind today’s surge was the liquidation of short positions across centralized exchanges. According to data from CoinGlass, approximately $318 million in short positions were liquidated over a 24-hour period, creating powerful upward pressure on Bitcoin’s price.

When traders use leverage to short Bitcoin and the cryptocurrency’s price rises unexpectedly, they are forced to buy Bitcoin back from the market to close their positions. This buying pressure can trigger a cascade effect, pushing prices higher and causing additional liquidations in what’s known as a short squeeze.

The scale of today’s short liquidations indicates that many traders were positioned for Bitcoin to decline or remain range-bound, making the rapid upward movement particularly painful for bears and potentially accelerating the rally as they were forced to cover their positions.

Broad Crypto Market Rally

Today’s gains weren’t limited to Bitcoin. The broader cryptocurrency market joined the rally for a second consecutive day, bringing renewed optimism to investors who had begun to lose hope that altcoins would show signs of life this year.

Major cryptocurrencies posted impressive gains:

- Ethereum (ETH): +2%

- Solana (SOL): +2%

- Dogecoin (DOGE): +5%

- Cardano (ADA): +5%

- XRP: +3%

- Litecoin (LTC): +3%

The synchronized rally across major cryptocurrencies suggests improving risk appetite across the entire digital asset ecosystem, rather than isolated strength in Bitcoin alone.

Crypto Stocks Surge in Tandem

Traditional financial markets also reflected the growing optimism around digital assets. Cryptocurrency-related stocks posted substantial gains, with Bitcoin mining companies and trading platforms benefiting from the positive sentiment.

Notable performers included:

- Mara Holdings (MARA): +2%

- Riot Platforms (RIOT): +2%

- Coinbase (COIN): +4%

- Robinhood (HOOD): +4%

The strong performance of crypto equities indicates that institutional investors are gaining confidence in the sustainability of the cryptocurrency rally, extending their exposure beyond direct digital asset holdings to include related equity investments.

Breaking the Range-Bound Pattern

Today’s record represents a significant breakthrough from Bitcoin’s recent trading pattern. The cryptocurrency had traded in a tight range for several weeks, maintaining stability above the $100,000 level for more than 60 consecutive days despite billions of dollars flowing into Bitcoin exchange-traded funds.

The ability to maintain price stability above six figures has been viewed as a major achievement for Bitcoin, demonstrating its capacity to handle substantial inflows without excessive volatility. Today’s breakout suggests that the market may be entering a new phase of price discovery.

Institutional Support Remains Strong

The rally comes against a backdrop of continued institutional support for Bitcoin. Public companies have maintained their Bitcoin buying spree, outpacing Bitcoin ETF inflows for the third consecutive quarter. This sustained institutional accumulation provides fundamental support for Bitcoin’s price trajectory.

Furthermore, progress on regulatory fronts, particularly Congress’s advancement of stablecoin legislation, has contributed to improved market sentiment. The prospect of clearer regulatory frameworks in the United States has helped reduce uncertainty and attract institutional capital to the cryptocurrency ecosystem.

Risk-On Market Environment

Today’s cryptocurrency rally coincides with a broader return to risk-on sentiment in traditional financial markets. The tech-heavy Nasdaq Composite also reached a record close on Wednesday, indicating that investors are increasingly comfortable with riskier assets across multiple sectors.

The synchronized strength between traditional risk assets and cryptocurrencies suggests that macroeconomic factors are favoring speculative investments. This correlation indicates that Bitcoin and other digital assets are increasingly being viewed as legitimate components of broader investment portfolios rather than isolated speculative bets.

Technical Implications

From a technical analysis perspective, Bitcoin’s breakout above previous resistance levels opens the door for further upside potential. The new all-time high provides a psychological boost for investors and could attract additional capital from traders waiting for confirmation of a sustained upward trend.

The combination of strong volume, short liquidations, and broad market participation suggests that today’s rally has solid foundations rather than being driven by speculative excess. This healthy technical foundation could support continued upward momentum in the coming weeks and months.

Looking Ahead

As Bitcoin establishes new price territory above $113,000, market participants will be watching for signs of sustained momentum versus potential consolidation. The current rally appears well-supported by fundamental factors including institutional adoption, regulatory progress, and improving risk sentiment.

The second half of the year was already expected to bring new heights for Bitcoin, and today’s record suggests those expectations may be conservative. With continued institutional inflows, improving regulatory clarity, and growing mainstream acceptance, Bitcoin appears well-positioned for additional gains in the coming months.

However, as with any rapidly moving market, investors should remain cautious about potential volatility, particularly given the magnitude of recent short liquidations which could indicate temporary overshooting of fair value.

This article reflects information available as of July 10, 2025. Market conditions and prices may have evolved since publication.