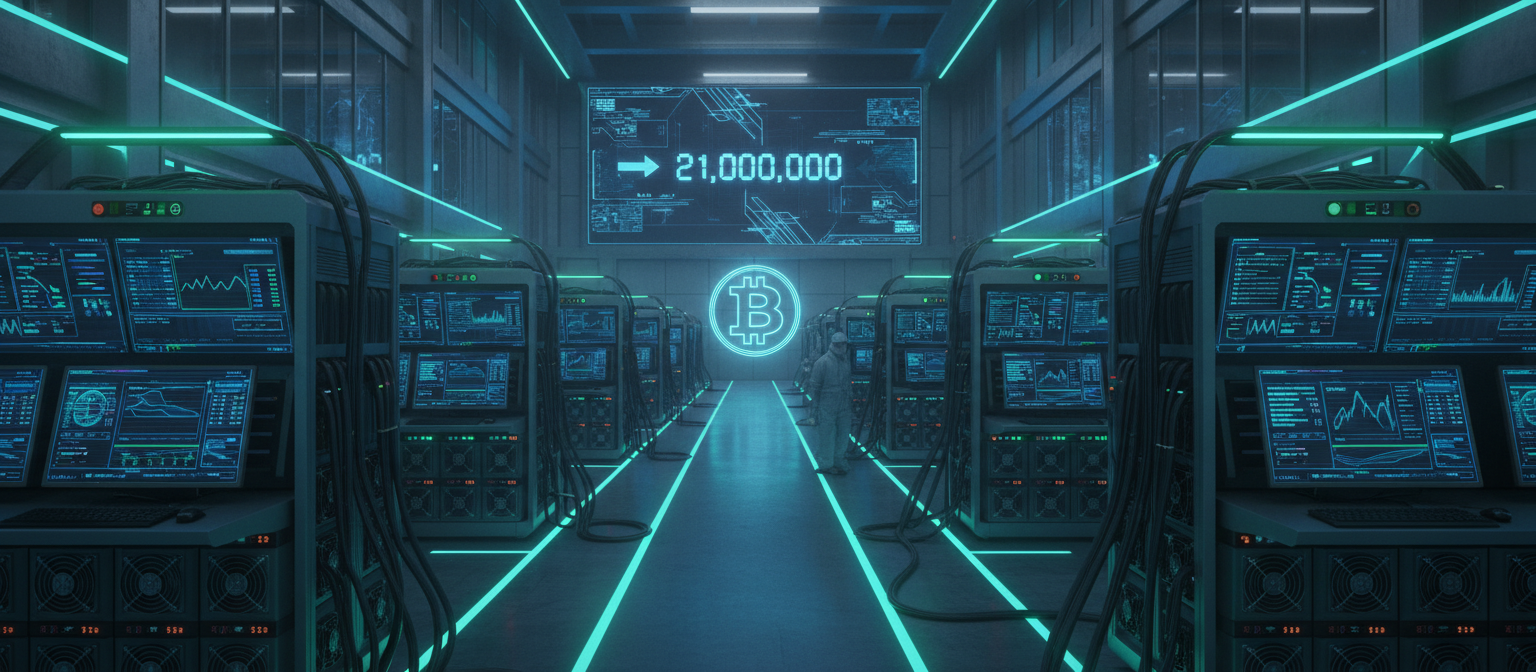

Bitcoin has reached a significant milestone in its journey toward digital scarcity, with approximately 93.3% of all Bitcoin that will ever exist now mined. As of August 2025, roughly 19.6 million BTC have been created, leaving only 1.4 million Bitcoin yet to be mined over the next 115 years.

This approaching supply limit represents one of Bitcoin’s most fundamental value propositions, yet many market participants underestimate the profound implications of reaching this finite cap.

The Mathematical Certainty of Scarcity

Bitcoin’s total supply is hardcoded at 21 million BTC, a fixed upper limit that cannot be altered without a consensus-breaking change to the protocol. This finite cap is enforced at the protocol level and creates what many consider to be the world’s first truly scarce digital asset.

The reason we’ve reached 93% so quickly lies in Bitcoin’s exponential issuance schedule, governed by the halving events that occur approximately every four years. When Bitcoin launched in 2009, the block reward was 50 BTC. Today, after four halving events, miners receive just 3.125 BTC per block.

Because the early rewards were so substantial, over 87% of the total supply was mined by the end of 2020. Each subsequent halving dramatically reduces the rate of new issuance, meaning it will take over a century to mine the remaining 6.7%.

According to current projections, 99% of all Bitcoin will have been mined by 2035, but the final satoshis won’t be produced until around the year 2140 due to the geometric nature of reward reduction.

The Hidden Scarcity: Lost Bitcoin

While 19.6 million Bitcoin have been mined, that doesn’t mean they’re all available for circulation. A significant portion is permanently out of circulation, lost due to forgotten passwords, misplaced wallets, destroyed hard drives, or early adopters who never touched their coins again.

Industry estimates from firms like Chainalysis and Glassnode suggest that between 3.0 million and 3.8 million BTC — roughly 14%-18% of the total supply — is likely gone for good. This includes high-profile dormant addresses like the one believed to belong to Satoshi Nakamoto, which alone holds over 1.1 million BTC.

This means Bitcoin’s true circulating supply may be closer to 16-17 million, not the headline figure of 19.6 million. And because Bitcoin is non-recoverable by design, any lost coins stay lost — permanently reducing supply over time.

This distinction gives Bitcoin a form of hardening scarcity that even gold cannot match. While around 85% of the world’s total gold supply has been mined, nearly all of it remains in circulation or held in vaults, jewelry, ETFs, and central banks. Gold can be remelted and reused; Bitcoin cannot be resurrected once access is lost.

Market Implications of Increasing Scarcity

As Bitcoin matures, it’s entering a monetary phase similar to gold: low issuance, high holder concentration, and increasing demand-side sensitivity. But Bitcoin takes the concept further with its hard supply cap, permanent loss rate, and publicly auditable distribution.

This convergence of factors could lead to several significant market outcomes:

Increased Price Volatility: As available supply becomes more limited and sensitive to market demand, price swings could become more pronounced, particularly during periods of high trading volume or macroeconomic stress.

Value Concentration: Higher long-term value concentration in the hands of those who remain active and secure in their key management practices.

Liquidity Premiums: A premium on liquid, spendable BTC that trades at higher effective values than dormant supply, particularly during times of constrained exchange liquidity.

In extreme scenarios, this could produce a bifurcation between “circulating BTC” and “unreachable BTC,” with the former gaining greater economic significance as the truly available supply becomes increasingly constrained.

Mining Economics Beyond the Block Reward

There’s a common misconception that as Bitcoin’s block rewards shrink, network security will eventually suffer. However, the mining economy has proven to be far more adaptive and resilient than many anticipate.

Bitcoin’s mining incentives operate through a self-correcting feedback loop. If mining becomes unprofitable, miners drop off the network, triggering a difficulty adjustment. Every 2,016 blocks (roughly every two weeks), the network recalibrates mining difficulty to keep block times steady at around 10 minutes, regardless of how many miners are competing.

This mechanism has already been tested at scale. After China banned mining in mid-2021, Bitcoin’s global hashrate dropped by more than 50% in weeks, yet the network continued functioning without interruption. Within months, the hashrate fully recovered as miners migrated to jurisdictions with lower energy costs and favorable regulations.

The idea that lower rewards will inherently threaten network security overlooks how mining is tied to profit margins, not nominal BTC amounts. As long as the market price supports the cost of hash power — even at future reduced block rewards — miners will continue to secure the network.

The Evolution Toward Sustainable Mining

It’s a common misconception that rising Bitcoin prices will drive endless energy consumption. In reality, mining is constrained by profitability, not price alone. As block rewards shrink, miners are pushed toward thinner margins, forcing them to seek the cheapest, cleanest energy available.

Since China’s 2021 mining ban, hashrate has migrated to regions like North America and Northern Europe, where operators tap into surplus hydro, wind, and underutilized grid energy. According to the Cambridge Centre for Alternative Finance, between 52% and 59% of Bitcoin mining now runs on renewables or low-emission sources.

Regulations are reinforcing this trend, with several jurisdictions offering incentives for clean-powered mining or penalizing fossil-fuel operations. The idea that higher BTC prices will always mean higher energy use misses how Bitcoin self-regulates: more miners raise difficulty, which compresses margins, capping energy expansion.

The Road to 21 Million

As Bitcoin approaches its supply cap, the market dynamics are likely to shift significantly. With only 1.4 million Bitcoin left to mine over 115 years, new supply will become increasingly negligible compared to the existing stock-to-flow ratio.

This mathematical certainty of scarcity, combined with the permanent loss of coins through accidents or neglect, creates a unique monetary asset that becomes scarcer over time rather than more abundant. Unlike traditional currencies that can be printed at will, or even commodities like gold whose supply continues to grow, Bitcoin’s supply is designed to decrease in availability.

For investors and market participants, understanding this timeline is crucial. The window for acquiring newly minted Bitcoin is closing rapidly, and future market participants will have to purchase Bitcoin from existing holders rather than from mining operations.

As we move closer to the 21 million cap, Bitcoin’s transition from a inflationary to a deflationary monetary policy will accelerate, potentially reshaping how we think about money, value, and economic scarcity in the digital age.

This article was published on August 18, 2025, and reflects information available as of that date.