Bitcoin shattered the $80,000 barrier today for the first time in its history, extending a powerful post-election rally that has added over $1 trillion to the cryptocurrency market since Donald Trump’s decisive victory last Tuesday. The milestone comes as the crypto industry celebrates an unprecedented political success story—having spent over $130 million on the 2024 elections, its favored candidates won at a remarkable 91% success rate.

The cryptocurrency passed $80,000 shortly after 12:00 pm GMT on Sunday, representing a 16% gain in just the five days since election day. Bitcoin has now climbed roughly 115% year-to-date, nearly doubling in value over 2024 and solidifying what may become the asset’s strongest annual performance since 2020.

Trump Victory Unleashes Pent-Up Demand

Bitcoin’s surge following Trump’s victory reflects the market’s belief that a fundamental shift in U.S. cryptocurrency policy is imminent. Trump campaigned explicitly on pro-crypto promises, vowing to make the United States “the crypto capital of the planet and the bitcoin superpower of the world.”

His specific commitments include establishing a strategic national Bitcoin reserve similar to the Strategic Petroleum Reserve, eliminating capital gains taxes on crypto transactions, and fostering an environment conducive to cryptocurrency company initial public offerings. These policy positions represent a dramatic departure from the current administration’s approach, which the crypto industry has characterized as “regulation by enforcement.”

The rally also benefited from the Federal Reserve’s decision to cut interest rates by 25 basis points on Thursday, reinforcing expectations of easier monetary policy that historically benefits risk assets like cryptocurrencies. The combination of pro-crypto political leadership and accommodative monetary policy has created what many analysts view as an ideal environment for continued price appreciation.

Beyond Bitcoin’s performance, the broader cryptocurrency market has surged even more dramatically. Ethereum has gained 32% since election day, while payment token XRP jumped 11%. The decentralized finance token associated with Cardano rocketed 40%. Even memecoins like Dogecoin and Shiba Inu soared 17% and 31% respectively, with Dogecoin receiving particular attention due to Trump ally Elon Musk’s vocal support.

Crypto’s Unprecedented Political Investment

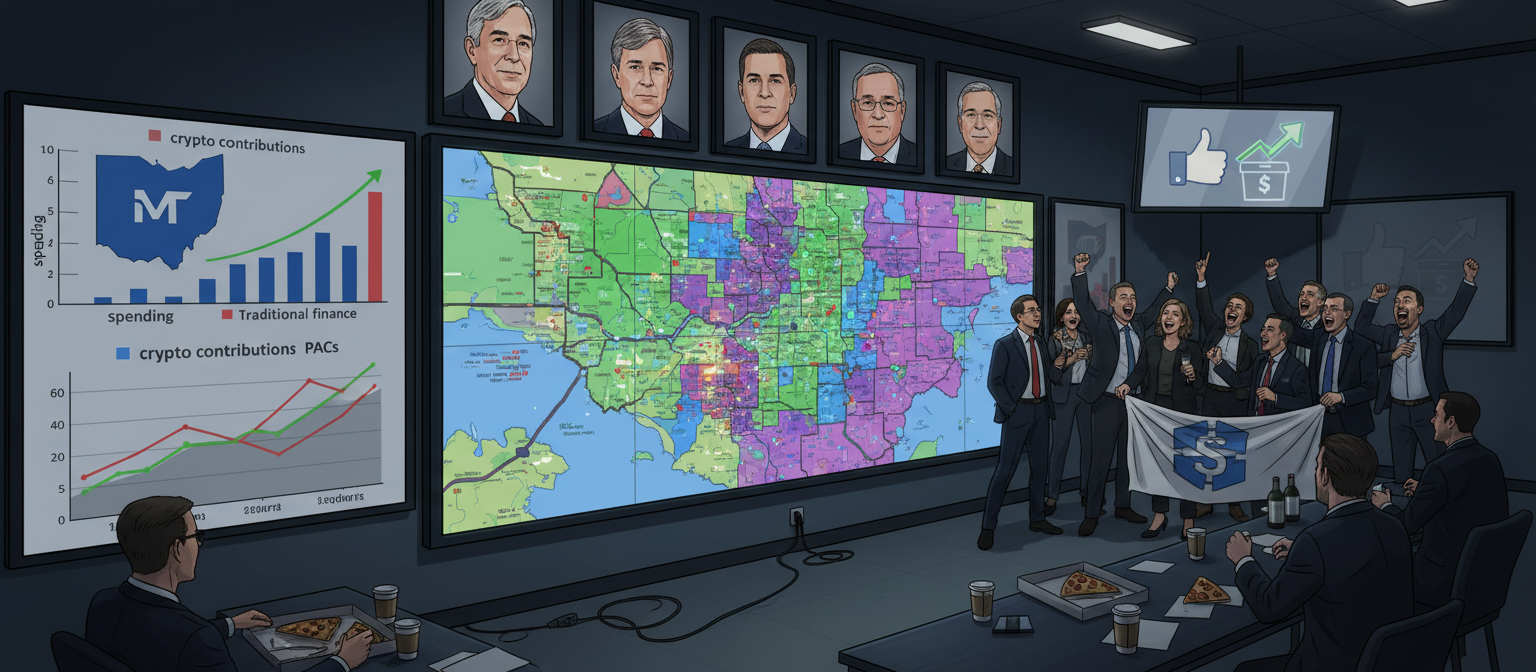

While Bitcoin’s price action has captured headlines, the election results represent an even more significant victory for the cryptocurrency industry’s long-term strategic positioning. The sector’s leading super PACs—Fairshake, Protect Progress, and Defend American Jobs—poured $131 million into congressional races this cycle, making crypto the largest corporate donor to the 2024 elections.

The results vindicate this unprecedented political investment strategy. Of the 58 races where crypto super PACs focused resources, their favored candidates won 53 contests—a 91% success rate that far exceeds typical political action committee performance. This success spans both parties, demonstrating the industry’s pragmatic approach to building bipartisan support rather than aligning exclusively with one political coalition.

The most consequential victory came in Ohio’s Senate race, where the industry spent $40 million backing Republican Bernie Moreno against three-term Democratic incumbent Sherrod Brown. Brown, who chairs the Senate Banking Committee that oversees digital finance regulation, has been one of cryptocurrency’s most vocal critics in Washington.

His defeat removes a powerful obstacle to crypto-friendly legislation and likely ensures that the Senate Banking Committee will take a fundamentally different approach to digital asset regulation in the next Congress. For an industry that has faced years of regulatory uncertainty and enforcement actions, this single race outcome may prove more valuable than any specific legislation.

Strategic Victories Across the Map

The crypto industry’s political success extended well beyond the Ohio Senate race, demonstrating sophisticated targeting across competitive contests:

Michigan Senate: $9.5 million spent supporting Democrat Elissa Slotkin, who won her race and is viewed as more favorable to crypto innovation than alternative candidates.

Arizona Senate: $9.2 million backed Democrat Ruben Gallego, who secured victory and has signaled openness to balanced cryptocurrency regulation.

Indiana Senate: Over $4 million promoted Republican Jim Banks in his successful campaign to represent Indiana in the Senate.

West Virginia Senate: More than $3.4 million aided Jim Justice in capturing the seat being vacated by Sen. Joe Manchin.

The industry’s willingness to support Democrats like Slotkin and Gallego alongside Republicans demonstrates a pragmatic approach focused on electing crypto-friendly candidates regardless of party affiliation. This bipartisan strategy insulates the industry from the risks of betting exclusively on one party while maximizing the number of sympathetic lawmakers.

Beyond Senate races, crypto super PACs targeted dozens of competitive House races, helping elect a new generation of pro-crypto lawmakers who will shape digital asset policy for years to come. With more than 50 members of the next Congress having received substantial crypto industry support, the sector has built a formidable coalition that spans both chambers and both parties.

What Crypto’s Political Victory Means for Policy

The crypto industry didn’t spend $130 million on elections for altruistic reasons—it expects concrete policy changes that will shape the regulatory landscape for digital assets. With Trump headed to the White House and crypto-friendly lawmakers controlling key committee positions, several major policy shifts appear increasingly likely.

SEC Leadership Change: Trump will appoint a new Securities and Exchange Commission chair, replacing Gary Gensler, whose aggressive enforcement approach has made him crypto’s primary regulatory adversary. A new chair sympathetic to digital asset innovation could fundamentally reshape how the SEC regulates cryptocurrencies, potentially providing the regulatory clarity the industry has long sought.

Congressional Legislation: With crypto-friendly lawmakers controlling key committees, comprehensive cryptocurrency legislation that has stalled for years may finally advance. Potential priorities include establishing clear definitions for digital asset categories, creating tailored regulatory frameworks for different crypto applications, and providing safe harbors for compliant projects.

Bitcoin Strategic Reserve: Trump’s promise to create a national Bitcoin reserve, while ambitious, now seems plausible with unified Republican control of government. Such a policy would represent an extraordinary validation of Bitcoin as a legitimate reserve asset and could trigger similar moves by other nations.

Reduced Enforcement Actions: The incoming administration is expected to take a dramatically different approach to crypto enforcement, focusing on providing regulatory clarity rather than pursuing aggressive enforcement actions against companies operating in legal gray areas.

Stablecoin Framework: Legislation establishing a clear regulatory framework for stablecoins appears likely to advance, potentially unlocking significant innovation in digital payments and cross-border transactions.

Market Implications and Next Targets

Today’s $80,000 breakthrough represents more than just a round number—it confirms that Bitcoin has entered a new bull market phase supported by both improving fundamentals and favorable political developments. With year-to-date gains approaching 115%, Bitcoin has already delivered exceptional returns, but many analysts believe significantly higher prices lie ahead.

The question now is how quickly Bitcoin can advance toward $90,000 and eventually challenge the psychologically significant $100,000 level. Historical patterns suggest that once Bitcoin breaks through major resistance levels, momentum often accelerates as new buyers enter and previously cautious investors increase their allocations.

Several factors support continued upside. Spot Bitcoin ETFs, which launched in January, continue to attract substantial institutional capital. The April halving reduced Bitcoin’s supply issuance by 50%, creating supply-side pressure that historically precedes major price rallies. And the prospect of a genuinely pro-crypto U.S. administration represents a fundamental change in the regulatory environment that could unlock institutional adoption that has been constrained by regulatory uncertainty.

However, risks remain. Bitcoin’s rapid appreciation has pushed many technical indicators into overbought territory, suggesting the possibility of near-term consolidation or pullbacks. The actual implementation of Trump’s crypto promises may take longer than markets currently anticipate, creating potential for disappointment. And regulatory changes, even favorable ones, often move slowly through the legislative and administrative process.

A Defining Moment for Crypto

November 10, 2024 may be remembered as a pivotal moment in cryptocurrency’s evolution from a fringe technology to a mainstream financial and political force. Bitcoin’s breakthrough above $80,000 provides the headline, but the more significant story is the crypto industry’s demonstration of political power.

By spending strategically and winning decisively, the cryptocurrency sector has secured a seat at the table where financial regulations are written. The days of crypto operating entirely outside traditional political channels appear to be ending, replaced by an industry sophisticated enough to play—and win—the Washington influence game.

For Bitcoin investors, today’s milestone represents validation that the post-election rally has fundamental support beyond mere speculation. For the crypto industry, the election results represent a hard-won political victory that could shape regulatory policy for years to come. And for policymakers, the message is clear: cryptocurrency is now a political force that cannot be ignored.

As Bitcoin trades at all-time highs and crypto-friendly lawmakers prepare to take office in January, the industry that was built on decentralization and resistance to government control has paradoxically secured its future by becoming a powerful Washington insider.

Information in this article reflects the state of the cryptocurrency market and political landscape as of November 10, 2024.